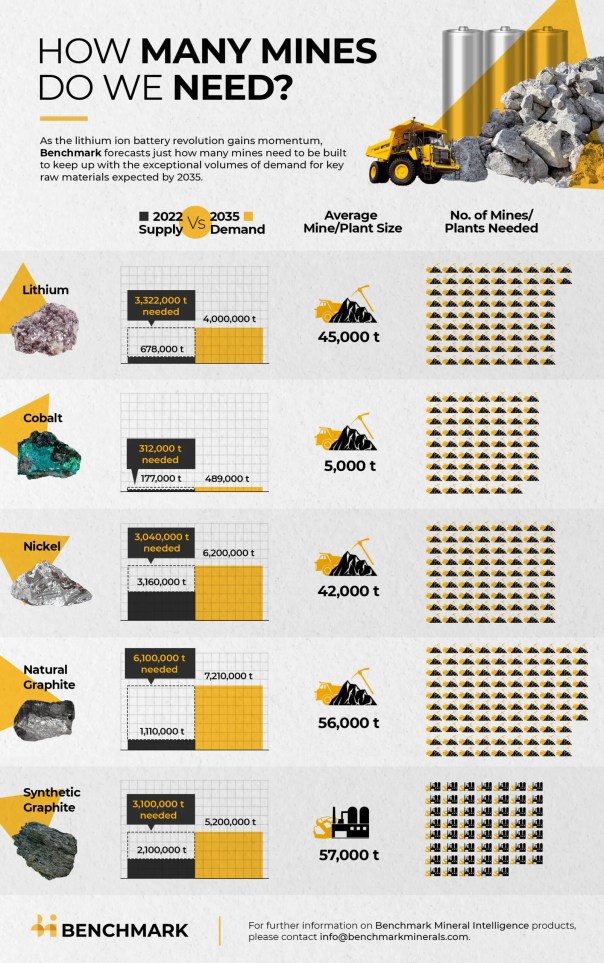

MORE THAN 300 NEW MINES REQUIRED TO MEET BATTERY DEMAND BY 2035

6th September 2022

Battery raw materials

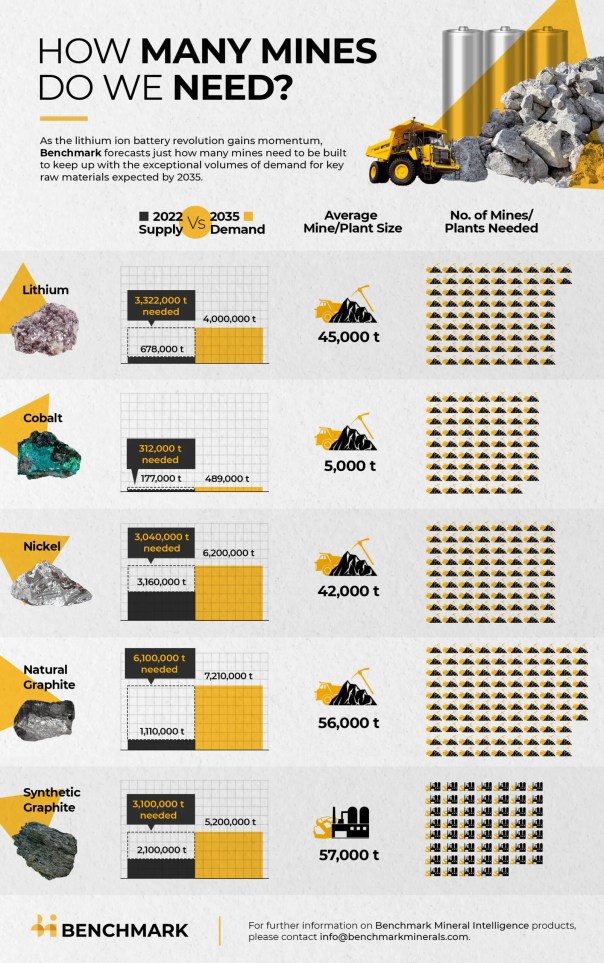

More than 300 new mines could need to be built over the next decade to meet the demand for electric vehicle and energy storage batteries, according to a Benchmark forecast.

At least 384 new mines for graphite, lithium, nickel and cobalt are required to meet demand by 2035, based on average mine sizes in each industry, according to Benchmark. Taking into account recycling of raw materials, the number is around 336 mines.

The data highlights the height of the raw material challenge facing global automakers as they look to scale up production of electric vehicles this decade. Demand for lithium ion batteries is set to grow six-fold by 2032, according to Benchmark.

Yet supplies of lithium, graphite, nickel and cobalt will need to keep pace with demand, especially post 2030.

While recycling of raw materials will have the most impact on future cobalt supply, it’s not yet set to have much impact on materials such as graphite, according to Benchmark.

Though given the shorter lead time to build recycling facilities, new recycling technologies could displace some of the new mine requirements.

GRAPHITE REQUIREMENTS

To meet demand for anode materials, an estimated 97 natural flake graphite mines will need to be built, assuming an average size of 56,000 tonnes a year and no contribution from recycling.

Natural graphite is normally mixed with synthetic graphite in lithium ion battery anodes.

There are currently over 70 mines operating globally with the majority located in China and Africa.

Current lithium ion battery recycling has focused on recovering the battery cathode materials rather than the anode, but recycling projects are starting to discuss recovery of anode materials too. Recycling and recovery of graphite is needed to reduce the dependence on mined materials.

For synthetic graphite, which is produced using pet needle coke or coal tar pitch a total of 54 plants with an average size of 57,000 tonnes will need to be built by 2035, according to Benchmark.

If the amount of silicon added to the battery anode increases more than Benchmark expects, however, then the number of new graphite mines needed would be lower.

LITHIUM RUSH

To meet the world’s lithium requirements would require 74 new lithium mines with an average size of 45,000 tonnes by 2035, according to Benchmark. Including forecast volumes from recycled lithium, however, it’s around 59 mines.

Since mines take at least five years to build these mines will need to be in operation by 2033, according to Cameron Perks, an analyst at Benchmark.

“That’s around 59 lithium mines up and running in just over 10 years,” he said.

Australia is set to remain the dominant producer of lithium this decade, according to Benchmark. There are currently over 13 lithium mines producing lithium-containing spodumene rock, over 75% of which is refined in China.

NICKEL AND COBALT

Yet another 72 mining projects with an average size of 42,500 tonnes will be required to meet battery demand for refined nickel, according to Benchmark.

Recycling, however, is set to have the biggest impact on cobalt mining. Without recycling, the world would need to build 62 new cobalt mining projects of 5,000 tonnes each by the end of 2035.

With forecast recycled volumes, however, that number falls by almost half to 38.

www.research-tree.com

www.research-tree.com