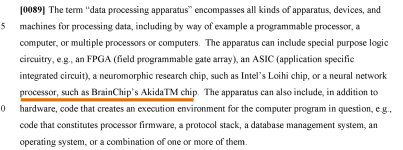

View attachment 67696

This is the paper I linked in my previous post, co-authored by Lars Niedermeier, a Zurich-based IT consultant, and the above-mentioned Jeff Krichmar from UC Irvine.

View attachment 67703

The two of them co-authored three papers in recent years, including one in 2022 with another UC Irvine professor and member of the CARL team, Nikil Dutt (

https://ics.uci.edu/~dutt/) as well as Anup Das from Drexel University, whose endorsement of Akida is quoted on the BrainChip website:

View attachment 67702

View attachment 67700

View attachment 67701

Lars Niedermeier’s and Jeff Krichmar’s April 2024 publication on CARLsim++ (which does not mention Akida) ends with the following conclusion and the acknowledgement that their work was supported by the Air Force Office of Scientific Research - the funding has been going on at least since 2022 -

and a UCI Beall Applied Innovation Proof of Product Award (

https://innovation.uci.edu/pop/)

and they also thank the regional NSF I-Corps (= Innovation Corps) for valuable insights.

View attachment 67699

View attachment 67704

Their use of an E-Puck robot (

https://en.m.wikipedia.org/wiki/E-puck_mobile_robot) for their work reminded me of our CTO’s address at the AGM in May, during which he envisioned the following object (from 22:44 min):

“Imagine a compact device similar in size to a hockey puck that combines speech recognition, LLMs and an intelligent agent capable of controlling your home’s lighting, assisting with home repairs and much more. All without needing constant connectivity or having to worry about privacy and security concerns, a major barrier to adaptation, particularly in industrial settings.”

Possibly something in the works here?

The version the two authors were envisioning in their April 2024 paper is, however, conceptualised as being available as a cloud service:

“We plan a hybrid approach to large language models available as cloud service for processing of voice and text to speech.”

The authors gave a tutorial on CARLsim++ at NICE 2024, where our CTO Tony Lewis was also presenting. Maybe they had a fruitful discussion at that conference in La Jolla, which resulted in UC Irvine’s Cognitive Anteater Robotics Laboratory (CARL) team experimenting with AKD1000, as evidenced in the video uploaded a couple of hours ago that I shared in my previous post?

View attachment 67705

www.gctronic.com

View attachment 67716

www.shm-afeela.com

www.shm-afeela.com