You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

BRN Discussion Ongoing

- Thread starter TechGirl

- Start date

cosors

👀

Don' get me wrong. I was so short tempered because my battery was at the end. I am definitely not a friend of camera only! Just it is so that Tesla is often unfairly attacked. I have many brothers and sisters. The first fight had to fight my grant sister ergo Tesla. After that everything was easier. Tesla has only enemies or fans. You always have to take that into account. I know you are about something else but I am not quite so maybe conservative or restrictive. I don't really see the added value in completely autonomous driving except that the already often immature drivers are even less attentive, but there is still its benefit and the industry wants it, so it happens. Only Tesla is often unfairly attacked even if I am not a friend of their system to repeat myself.Don't be so hasty (?) against Tesla. The last video was already not cleared up. This one comes straight from China which is fighting on all fronts against the economy that is not its own. This could just as easily be fake. We don't know.

https://www.mining.com/web/china-linked-bots-attacking-rare-earths-producer-every-day/

cosors

👀

Jeff, your words really resonate with me. I wish you all the best. You still have to experience with us the time when ReRAM and Akida conquer the market so that your great plan comes true! I try to sent you transcedental strength. Your attitude towards life is a role model for me. In thoughts with you!Ah, FF - At last I can reveal that you're not always 100% correct!!

1) I checked on the jelly beans and there are only 689 in the jar. I couldn't help myself. I ate three.

2) You needn't have lost any sleep over the Plavix causing a brain haemorrhage. Since my major heart-out-of-chest surgery, my blood's been medicated down to the viscosity of water. So if I nick myself, I bleed for hours. If I bump myself I bruise black and blue. My nose bleeds every day. But that's a good thing - so I'm told. These minor leaks act as safety valves and take the pressure off the vessels in the brain. So I'm less likely to have a major cerebral haemorrhage like my mother did. Now, it seems that your eyes have simply acted as a safety valve to protect your brain!

Glad you're back here and that your health's improving! Don't over-do it.

Jeff

Last edited:

cosors

👀

Any questions?!Don't be so hasty (?) against Tesla. The last video was already not cleared up. This one comes straight from China which is fighting on all fronts against the economy that is not their own. This could just as easily be fake. We don't know.

https://www.mining.com/web/china-linked-bots-attacking-rare-earths-producer-every-day/

https://m.ixigua.com/video/7135991307670913539?logTag=955db0b591bf90ec2ab4

A string of accidents and always the camera is there

____

However, the video has a scene that reminds me of a unique situation that happened to me and with which a camera only system certainly has a problem - but extremely special. I was driving on the autobahn. It was snowing so "wet" and heavily that everything was covered with snow - really everything from all sides. Every bollard of the guardrail, every sign completely covered, just everything. I was driving at walking speed and slower because I had no lane of other vehicles in front of me. I had noticed zero contrasts, just white. I only noticed that I was getting close to the edge of the highway because the ground was getting slightly uneven and had to counter steered. One of or maybe the most blatant ride I've ever had. Fortunately, it was only a few kilometers. But that's when I would have liked radar, believe me! Actually, almost no one believes me to this day. But that's how it was. No matter how hard I concentrated I couldn't make out if I was still on the roadway. Just gps or better Galileo would have been a joy - just riding with the display of my phone. But it was before the time of smartphones.

Last edited:

Sirod69

bavarian girl ;-)

Into the Metaverse: Virtual Platforms Are Essential for Building and Deploying Safe Autonomous Vehicles

AI and the metaverse are turning vehicles from fixed function devices to truly software-defined machines. This transformation extends to everything that moves, including personal transportation, shared mobility, long haul trucking and last mile delivery. These new vehicles with autonomous driving and intelligent cockpit capabilities can dramatically improve safety and efficiency.The development of AVs begins in the data center, where a high-performance AI infrastructure exhaustively trains, tests, and validates the deep neural networks running in the vehicle.

inexplicably .. somehow I only see mercedes everywhere

Into the Metaverse: Virtual Platforms Are Essential for Building and Deploying Safe Autonomous Vehicles

Incredible advances in the virtual world are driving the deployment of AI-powered transportation in the real one. And you can experience it all for free at GTC in September.

which of the participating companies could be our customers

NVIDIA GTC Developer Conference Session Catalog

Free registration. September 19-22, 2022.

View attachment 15469

Sirod69

bavarian girl ;-)

Imperas partners with Intel Pathfinder for RISC-V

New Integrated Development Environment for RISC-V includes Imperas simulator and reference model as a fixed platform kit for software development and architectural analysisOxford, United Kingdom, August 30, 2022 — Imperas Software Ltd., the leader in RISC-V simulation solutions, today announced a strategic alliance with Intel® regarding Intel® Pathfinder for RISC-V*. Imperas has designed an integrated reference model and simulator as a fixed platform kit to support the growing ecosystem of RISC V. Imperas models are the established reference for RISC V and are now included as a fixed virtual platform as part of the Intel Pathfinder for RISC-V Professional Edition.

The Imperas simulator with proprietary just-in-time code-morphing simulation technology can be integrated within other standard EDA environments such as SystemC, SystemVerilog, and well-known simulation/emulation tools from Cadence, Siemens EDA, and Synopsys plus the cloud-based offering from Metrics Technologies.

Todd Vierra (BRN) is a contact.

Imperas partners with Intel Pathfinder for RISC-V

Design And Reuse - Catalog of IP Cores and Silicon on Chip solutions for IoT, Automotive, Security, RISC-V, AI, ... and Asic Design Platforms and Resources

Mt09

Regular

Can’t see Todd mentioned?Imperas partners with Intel Pathfinder for RISC-V

New Integrated Development Environment for RISC-V includes Imperas simulator and reference model as a fixed platform kit for software development and architectural analysis

Oxford, United Kingdom, August 30, 2022 — Imperas Software Ltd., the leader in RISC-V simulation solutions, today announced a strategic alliance with Intel® regarding Intel® Pathfinder for RISC-V*. Imperas has designed an integrated reference model and simulator as a fixed platform kit to support the growing ecosystem of RISC V. Imperas models are the established reference for RISC V and are now included as a fixed virtual platform as part of the Intel Pathfinder for RISC-V Professional Edition.

The Imperas simulator with proprietary just-in-time code-morphing simulation technology can be integrated within other standard EDA environments such as SystemC, SystemVerilog, and well-known simulation/emulation tools from Cadence, Siemens EDA, and Synopsys plus the cloud-based offering from Metrics Technologies.

Todd Vierra (BRN) is a contact.

Imperas partners with Intel Pathfinder for RISC-V

Design And Reuse - Catalog of IP Cores and Silicon on Chip solutions for IoT, Automotive, Security, RISC-V, AI, ... and Asic Design Platforms and Resourceswww.design-reuse.com

Sirod69

bavarian girl ;-)

He is in contact with them on LinkedInCan’t see Todd mentioned?

TheUnfairAdvantage

Regular

What are the chances. Now that would put a fire into the shorters backside!

Well, it paid off for quite a considerable time, unfortunately. Hopefully our AKIDA Ballista tech, ( somehow ) will shorten these criminal dilemma's judiciously, In a very quick smart way, to the benefit of all of us. Is this possible I wonder ??Off topic.

Chris Dawson found guilty of killing his wife 40 years ago the law finally caught up with him.

As the say crime doesn't pay........

This bastard almost got away with it scot free. Finally, he'll pay a price for all concerned to witness.

Any thoughts on this topic FF, and Akida's involvement moving forward ?

hotty...

Sirod69

bavarian girl ;-)

That sounds really great, what does it mean now for nvidia?

Fact Finder

Top 20

I don’t want to be judged by my toaster or vacuum cleaner.

My view on machine justice.

FF

AKIDA BALLISTA

My view on machine justice.

FF

AKIDA BALLISTA

Q: BrainChip customers are already deploying smarter endpoints with independent learning and inference capabilities, faster response times, and a lower power budget. Can you give us some real-world examples of how AKIDA is revolutionizing AI inference at the edge?

Peter: Automotive is a good place to start. Using AKIDA-powered sensors and accelerators, automotive companies can now design lighter, faster, and more energy efficient in-cabin systems that enable advanced driver verification and customization, sophisticated voice control technology, and next-level gaze estimation and emotion classification capabilities.

In addition to redefining the automotive in-cabin experience, AKIDA is helping enable new computer vision and LiDAR systems to detect vehicles, pedestrians, bicyclists, street signs, and objects with incredibly high levels of precision. We’re looking forward to seeing how these fast and energy efficient ADAS systems help automotive companies accelerate the rollout of increasingly advanced assisted driving capabilities.

In the future, we’d also like to power self-driving cars and trucks. But we don’t want to program these vehicles. To achieve true autonomy, cars and trucks must independently learn how to drive in different environmental and topographical conditions such as icy mountain roads with limited visibility, crowded streets, and fast-moving highways

With AKIDA, these driving skills can be easily copied and adaptable by millions of self-driving vehicles. This is a particularly important point. AKIDA driving updates will be based on real-world knowledge and skills other cars have learned on the road. We want to avoid boilerplate firmware updates pushed out by engineering teams sitting in cubes. A programmed car lacking advanced learning and inferential capabilities can’t anticipate, understand, or react to new driving scenarios. That’s why BrainChip’s AKIDA focuses on efficiently learning, inferring, and adapting new skills.

Q: Aside from automotive, what are some other multimodal edge use cases AKIDA enables?

Peter: Smart homes, automated factories and warehouses, vibration monitoring and analysis of industrial equipment, as well as advanced speech and facial recognition applications. AKIDA is also accelerating the design of robots using sophisticated sensors to see, hear, smell, touch, and even taste.

I also suggest everyone to read "Designing Smarter and Safer Cars with Essential AI" from https://brainchip.com/?utm_campaign=White Paper 2 - Automotive

Last edited:

I tried to make the point on the weekend that Brainchip's house has many rooms prepared and in one of those already occupied rooms is Renesas. In another is ARM. (Important to remember as you read the article below.) Renesas is one of those unromantic companies that most Australians and even Americans would not recognise by name even though they have a huge reach around the world and are the world wide number one supplier of MCU's. As part of my effort to evangelise to all new shareholders and even the not so new that Brainchip a bit like Renesas has according to the author of the following document quietly and effectively been building a world class ecosystem of partners and customers just as Renesas has over many decades. Take the time to read the following you will be impressed with Brainchips involvement with Renesas:

CLOUD

Renesas Rising Beyond Automotive Into IoT And Infrastructure

Patrick Moorhead

Senior Contributor

I write about disruptive companies, technologies and usage models.

New! Follow this author to stay notified about their latest stories. Got it!

Follow

Feb 25, 2022,02:20pm EST

Listen to article12 minutes

https://policies.google.com/privacy

In the world of tech, success takes many forms. Some "it" companies blow up overnight. A lucky few of them manage to parlay the hype into long-term success, eventually finding their sea legs. I've got a particular appreciation for the slower-burn companies, the unsung heroes who toil behind the scenes, amassing impressive portfolios of IP over the years that you've probably used before without realizing.

One such company, in my mind, is Renesas Electronics Corporation, headquartered in Tokyo. Founded in 2002 (with operations beginning in 2010). Renesas is the #1 MCU supplier in the world and well known for its automotive capabilities over many decades.

Now, under Representative Director, President and CEO Shibata-san’s leadership, under the mission of “Making People’s Lives easier,” he has expanded scope into the IoT, industrial and infrastructure markets. I think the unsung piece of the Renesas story is the IIBU (IoT and Infrastructure Business Unit). When you combine next-generation cars to the booming industrial IoT space to smart cities and infrastructure, intelligent endpoints have never been a hotter commodity than the present moment. And quite the investment opportunity.

I’d like to spend some time talking about the IIBU.

Technology trends driving growth opportunities

Last month I listened in on a talk delivered by Sailesh Chittipeddi, Executive VP and GM of Renesas' IoT and Infrastructure Business Unit, concerning the company's growth in IIoT. Chittipeddi led off by citing a few notable trends aiding growth: migration to the smart factory, a growing emphasis on sustainability, a shift from ASICs towards more standard products and the popularization of brushless DC motors.

IIOT and Industrial Growth A Snapshot 2020 - 2021

RENESAS

MORE FROMFORBES ADVISOR

Best Travel Insurance Companies

By

Amy Danise

Editor

Best Covid-19 Travel Insurance Plans

By

Amy Danise

Editor

Above, you can see Renesas's projected growth in IoT (30% CAGR), Infrastructure (18% CAGR) and Industrial (15% CAGR) segments for the 2020-2021 period. Chittipeddi warned against attributing Renesas's IoT and Industrial growth to a "rising tides raise all ships" scenario. He pointed out that Renesas doesn't operate as a broad-based point product provider, unlike some competitors. Instead, Renesas targets several specific market areas with its industrial automation and motor control offerings.

In the realm of infrastructure, Renesas's growth is coming predominately from datacenter-focused infrastructure power, timing and memory interfaces. In IoT, the company's core microcontroller business is doing the heavy lifting. In the industrial sector, the ASIC and MPU businesses are driving growth. Overall, Renesas's Industrial Automation segment grew approximately 20% from 2020 to 2021, while its Motor Control segment grew by 30% over the same period. As this growth likely connects to the broader digital transformation and modernization trend across industries, I don't expect to see it slow down any time soon. The widespread adoption of 5G, Wi-Fi 6 and 6e connectivity standards should only accelerate these trends further.

Growth and profit in the industrial sector

Looking at the financials for Renesas's industrial segment since 2019 (see slide below), we can see several positive trends worth noting. Revenue in the industrial segment has grown at a 23% CAGR, gross profits have grown at a 31% CAGR and the segment's operating income has shot through the roof at a CAGR of 62%.

IIOT and Industrial Financial Trends At a Glance

RENESAS

Renesas already has an impressive global customer base in industrial automation. This includes companies such as Rockwell Automation and Emerson in the Americas, Siemens, Hilscher and Schneider Electric in Europe, Inovance and Delta in the Asia-Pacific region and heavy hitters Mitsubishi Electric, Fanuc and Yaskawa in Japan.

With these and many other customers under its belt, Renesas touts itself as a leading semiconductor supplier for "Industry 4.0." In this vision for the future, highly integrated smart factories dominate the industrial landscape, promising to significantly enhance productivity, efficiency, and safety by implementing advanced automation, control, monitoring, and analysis capabilities.

Industrial Automation Pyramid

RENESAS

Industrial automation

Renesas illustrates its place in the world of industrial automation with a helpful pyramid graphic (see above). At the bottom, the Access Layer consists of the various technology that operates on the factory floor. Here, intelligent sensors and actuators connected through a local field network gather data and send it up the stack for control, monitoring and analysis. The second layer, the Control Layer, includes the system or industrial network and its processes—namely, automation, monitoring and control. Lastly, the Analysis Layer at the top of the pyramid is where most computing and data analysis occurs. Current technological limitations relegate most of this work to the cloud.

As you can see, Renesas's portfolio of digital, analog, timing and standard products are well-represented in the industrial automation pyramid. Renesas offers MPUs, MCUs, PMICs, ASICs, and timing solutions for the Control Layer. In the Access Layer, Renesas provides Smart SSCs, MCUs and sensors for air quality, humidity, position and flow, and interface solutions such as ASICs with IO-link and ASi.

The company's comprehensive portfolio, in my opinion, makes it uniquely positioned to deliver the levels of integration necessary to make "Industry 4.0" a reality. The company's preexisting relationships with big-name customers should also help with integration. Lastly, it's worth mentioning several recent Renesas acquisitions that have augmented the company's value proposition even further.

Dialog Semiconductor, purchased last August, gave Renesas crucial battery management capabilities, Bluetooth low-energy, Wi-Fi, Flash memory and Configurable mixed-signal custom integrated circuits (ICs). This technology, according to Renesas, should help it improve the power efficiency, charge times, performance and productivity of its offerings.

Last October, Renesas also bought Celeno, a company specializing in connectivity solutions. Celeno's Wi-Fi 6 and 6e technology promises to benefit Renesas's industrial automation portfolio by providing higher network capacity, improved signal reliability, lower latency and the ability to mitigate crowded networks.

Our Som Growth

RENESAS

I believe all of this translates to a compelling growth story. In the figure above, you can see that Renesas anticipates its SOM (serviceable obtainable market) in industrial automation will outpace the growth of the segment's overall SAM (serviceable addressable market). In other words, not only is the market for industrial automation growing at an impressive rate (11% CAGR), but Renesas's market share is simultaneously growing within it and growing more quickly at that. Whereas Renesas claimed 8% of the overall industrial automation market in 2020, it projects it will secure 9% by 2025.

Motor control

This brings us to motor controls, Renesas's second area of focus in IoT and IIoT. Typically, a motor system consists of gears, a motor and an encoder. Of the different motor types, some examples include BLDC motors (for air conditioners, refrigerators), AC servo motors (which we typically see in industrial automation environments), fan motors (for PCs, servers) and stepping motors (utilized in printers and cameras). As mentioned briefly earlier, the movement away from AC motors towards BLDCs is a trend Renesas is gainfully riding.

Renesas's preexisting customer base is also an advantage in the motor control area. It has years of engineering know-how and customer relationships with makers of power tools, electric motors and machine tools. Its motor control base includes American household brands such as Whirlpool, GE Appliances and Emerson Electric (acquired by Nidec in Japan), European companies such as Miele, Grundfos and Bosch, APAC companies like Delta, Haier (parent company to GE Appliances) and Midea, and Japanese stalwarts Daikin, Hitachi and Mitsubishi Electric. According to Chittibeddi, these key customers form "a strong base" that is the primary driver behind Renesas's innovation engine.

MCU No. 1 Share and Strength For Motor Control

RENESAS

Renesas's market leadership in motor control has historically come from its strength in MCUs, or microcontrollers, that feature Renesas's proprietary cores. However, over the last several years, Renesas launched its RA family of MCUs, which instead leverage 32-bit Arm cores. The rollout of the RA family, starting with the RA2 in 2018, has been aggressive and impressive in equal measure. Though its leading competitor in the Arm ecosystem had a lengthy head start, having launched its first Arm-based MCU in 2010, Renesas has now effectively closed the gap from both a hardware and a software standpoint. As of 2020, Renesas now has Arm-based MCUs that cover the whole range of motor control applications, from the low end (small household and kitchen appliances) to mid-range (large household appliances) to the high end (robotics and other highly advanced applications). With its upcoming RA8 MCUs, Renesas predicts it will finally overtake the competition with the most advanced Arm core on the MCU market.

MCU Product For Motor Control Applications

RENESAS

Wrapping up

Renesas has a busy 2022 on tap and I look forward to following the company more closely than I have in the past. As it currently stands, we'll be hearing more from Renesas at the Embedded World conference in Nuremberg, Germany, in June, the not-to-miss Arm Developer Summit in the Bay Area in October and the Electronica conference in Munich, Germany, in November. At these events, I'll be watching to see if the company's gains in industrial automation and motor control live up to current projections and how Renesas plans to keep the momentum going through 2022 and beyond.

Next week, I will be listening into the company’s investor call to get the latest and greatest.

MY OPINION ONLY DO DYOR

FF

AKIDA BALLISTA

Great post FF, and it's good to have your intellect, again, back on these threads giving all the 1000I tried to make the point on the weekend that Brainchip's house has many rooms prepared and in one of those already occupied rooms is Renesas. In another is ARM. (Important to remember as you read the article below.) Renesas is one of those unromantic companies that most Australians and even Americans would not recognise by name even though they have a huge reach around the world and are the world wide number one supplier of MCU's. As part of my effort to evangelise to all new shareholders and even the not so new that Brainchip a bit like Renesas has according to the author of the following document quietly and effectively been building a world class ecosystem of partners and customers just as Renesas has over many decades. Take the time to read the following you will be impressed with Brainchips involvement with Renesas:

CLOUD

Renesas Rising Beyond Automotive Into IoT And Infrastructure

Patrick Moorhead

Senior Contributor

I write about disruptive companies, technologies and usage models.

New! Follow this author to stay notified about their latest stories. Got it!

Follow

Feb 25, 2022,02:20pm EST

Listen to article12 minutes

https://policies.google.com/privacy

In the world of tech, success takes many forms. Some "it" companies blow up overnight. A lucky few of them manage to parlay the hype into long-term success, eventually finding their sea legs. I've got a particular appreciation for the slower-burn companies, the unsung heroes who toil behind the scenes, amassing impressive portfolios of IP over the years that you've probably used before without realizing.

One such company, in my mind, is Renesas Electronics Corporation, headquartered in Tokyo. Founded in 2002 (with operations beginning in 2010). Renesas is the #1 MCU supplier in the world and well known for its automotive capabilities over many decades.

Now, under Representative Director, President and CEO Shibata-san’s leadership, under the mission of “Making People’s Lives easier,” he has expanded scope into the IoT, industrial and infrastructure markets. I think the unsung piece of the Renesas story is the IIBU (IoT and Infrastructure Business Unit). When you combine next-generation cars to the booming industrial IoT space to smart cities and infrastructure, intelligent endpoints have never been a hotter commodity than the present moment. And quite the investment opportunity.

I’d like to spend some time talking about the IIBU.

Technology trends driving growth opportunities

Last month I listened in on a talk delivered by Sailesh Chittipeddi, Executive VP and GM of Renesas' IoT and Infrastructure Business Unit, concerning the company's growth in IIoT. Chittipeddi led off by citing a few notable trends aiding growth: migration to the smart factory, a growing emphasis on sustainability, a shift from ASICs towards more standard products and the popularization of brushless DC motors.

IIOT and Industrial Growth A Snapshot 2020 - 2021

RENESAS

MORE FROMFORBES ADVISOR

Best Travel Insurance Companies

By

Amy Danise

Editor

Best Covid-19 Travel Insurance Plans

By

Amy Danise

Editor

Above, you can see Renesas's projected growth in IoT (30% CAGR), Infrastructure (18% CAGR) and Industrial (15% CAGR) segments for the 2020-2021 period. Chittipeddi warned against attributing Renesas's IoT and Industrial growth to a "rising tides raise all ships" scenario. He pointed out that Renesas doesn't operate as a broad-based point product provider, unlike some competitors. Instead, Renesas targets several specific market areas with its industrial automation and motor control offerings.

In the realm of infrastructure, Renesas's growth is coming predominately from datacenter-focused infrastructure power, timing and memory interfaces. In IoT, the company's core microcontroller business is doing the heavy lifting. In the industrial sector, the ASIC and MPU businesses are driving growth. Overall, Renesas's Industrial Automation segment grew approximately 20% from 2020 to 2021, while its Motor Control segment grew by 30% over the same period. As this growth likely connects to the broader digital transformation and modernization trend across industries, I don't expect to see it slow down any time soon. The widespread adoption of 5G, Wi-Fi 6 and 6e connectivity standards should only accelerate these trends further.

Growth and profit in the industrial sector

Looking at the financials for Renesas's industrial segment since 2019 (see slide below), we can see several positive trends worth noting. Revenue in the industrial segment has grown at a 23% CAGR, gross profits have grown at a 31% CAGR and the segment's operating income has shot through the roof at a CAGR of 62%.

IIOT and Industrial Financial Trends At a Glance

RENESAS

Renesas already has an impressive global customer base in industrial automation. This includes companies such as Rockwell Automation and Emerson in the Americas, Siemens, Hilscher and Schneider Electric in Europe, Inovance and Delta in the Asia-Pacific region and heavy hitters Mitsubishi Electric, Fanuc and Yaskawa in Japan.

With these and many other customers under its belt, Renesas touts itself as a leading semiconductor supplier for "Industry 4.0." In this vision for the future, highly integrated smart factories dominate the industrial landscape, promising to significantly enhance productivity, efficiency, and safety by implementing advanced automation, control, monitoring, and analysis capabilities.

Industrial Automation Pyramid

RENESAS

Industrial automation

Renesas illustrates its place in the world of industrial automation with a helpful pyramid graphic (see above). At the bottom, the Access Layer consists of the various technology that operates on the factory floor. Here, intelligent sensors and actuators connected through a local field network gather data and send it up the stack for control, monitoring and analysis. The second layer, the Control Layer, includes the system or industrial network and its processes—namely, automation, monitoring and control. Lastly, the Analysis Layer at the top of the pyramid is where most computing and data analysis occurs. Current technological limitations relegate most of this work to the cloud.

As you can see, Renesas's portfolio of digital, analog, timing and standard products are well-represented in the industrial automation pyramid. Renesas offers MPUs, MCUs, PMICs, ASICs, and timing solutions for the Control Layer. In the Access Layer, Renesas provides Smart SSCs, MCUs and sensors for air quality, humidity, position and flow, and interface solutions such as ASICs with IO-link and ASi.

The company's comprehensive portfolio, in my opinion, makes it uniquely positioned to deliver the levels of integration necessary to make "Industry 4.0" a reality. The company's preexisting relationships with big-name customers should also help with integration. Lastly, it's worth mentioning several recent Renesas acquisitions that have augmented the company's value proposition even further.

Dialog Semiconductor, purchased last August, gave Renesas crucial battery management capabilities, Bluetooth low-energy, Wi-Fi, Flash memory and Configurable mixed-signal custom integrated circuits (ICs). This technology, according to Renesas, should help it improve the power efficiency, charge times, performance and productivity of its offerings.

Last October, Renesas also bought Celeno, a company specializing in connectivity solutions. Celeno's Wi-Fi 6 and 6e technology promises to benefit Renesas's industrial automation portfolio by providing higher network capacity, improved signal reliability, lower latency and the ability to mitigate crowded networks.

Our Som Growth

RENESAS

I believe all of this translates to a compelling growth story. In the figure above, you can see that Renesas anticipates its SOM (serviceable obtainable market) in industrial automation will outpace the growth of the segment's overall SAM (serviceable addressable market). In other words, not only is the market for industrial automation growing at an impressive rate (11% CAGR), but Renesas's market share is simultaneously growing within it and growing more quickly at that. Whereas Renesas claimed 8% of the overall industrial automation market in 2020, it projects it will secure 9% by 2025.

Motor control

This brings us to motor controls, Renesas's second area of focus in IoT and IIoT. Typically, a motor system consists of gears, a motor and an encoder. Of the different motor types, some examples include BLDC motors (for air conditioners, refrigerators), AC servo motors (which we typically see in industrial automation environments), fan motors (for PCs, servers) and stepping motors (utilized in printers and cameras). As mentioned briefly earlier, the movement away from AC motors towards BLDCs is a trend Renesas is gainfully riding.

Renesas's preexisting customer base is also an advantage in the motor control area. It has years of engineering know-how and customer relationships with makers of power tools, electric motors and machine tools. Its motor control base includes American household brands such as Whirlpool, GE Appliances and Emerson Electric (acquired by Nidec in Japan), European companies such as Miele, Grundfos and Bosch, APAC companies like Delta, Haier (parent company to GE Appliances) and Midea, and Japanese stalwarts Daikin, Hitachi and Mitsubishi Electric. According to Chittibeddi, these key customers form "a strong base" that is the primary driver behind Renesas's innovation engine.

MCU No. 1 Share and Strength For Motor Control

RENESAS

Renesas's market leadership in motor control has historically come from its strength in MCUs, or microcontrollers, that feature Renesas's proprietary cores. However, over the last several years, Renesas launched its RA family of MCUs, which instead leverage 32-bit Arm cores. The rollout of the RA family, starting with the RA2 in 2018, has been aggressive and impressive in equal measure. Though its leading competitor in the Arm ecosystem had a lengthy head start, having launched its first Arm-based MCU in 2010, Renesas has now effectively closed the gap from both a hardware and a software standpoint. As of 2020, Renesas now has Arm-based MCUs that cover the whole range of motor control applications, from the low end (small household and kitchen appliances) to mid-range (large household appliances) to the high end (robotics and other highly advanced applications). With its upcoming RA8 MCUs, Renesas predicts it will finally overtake the competition with the most advanced Arm core on the MCU market.

MCU Product For Motor Control Applications

RENESAS

Wrapping up

Renesas has a busy 2022 on tap and I look forward to following the company more closely than I have in the past. As it currently stands, we'll be hearing more from Renesas at the Embedded World conference in Nuremberg, Germany, in June, the not-to-miss Arm Developer Summit in the Bay Area in October and the Electronica conference in Munich, Germany, in November. At these events, I'll be watching to see if the company's gains in industrial automation and motor control live up to current projections and how Renesas plans to keep the momentum going through 2022 and beyond.

Next week, I will be listening into the company’s investor call to get the latest and greatest.

MY OPINION ONLY DO DYOR

FF

AKIDA BALLISTA

Akida Ballista To the moon and back >>>>> Could we be onboard Orion perhaps ?? <<<<<

hotty...

Wickedwolf

Regular

“I don't really see the added value in completely autonomous driving” look up Tony Seba or Ark invest and they will give you billions of reasonsDon' get me wrong. I was so short tempered because my battery was at the end. I am definitely not a friend of camera only! Just it is so that Tesla is often unfairly attacked. I have many brothers and sisters. The first fight had to fight my grant sister ergo Tesla. After that everything was easier. Tesla has only enemies or fans. You always have to take that into account. I know you are about something else but I am not quite so maybe conservative or restrictive. I don't really see the added value in completely autonomous driving except that the already often immature drivers are even less attentive, but there is still its benefit and the industry wants it, so it happens. Only Tesla is often unfairly attacked even if I am not a friend of their system to repeat myself.

stuart888

Regular

Fantastic. "Using AKIDA-powered sensors and accelerators, automotive companies...".This is a great read. Thanks for posting @Dozzaman1977

Q: BrainChip customers are already deploying smarter endpoints with independent learning and inference capabilities, faster response times, and a lower power budget. Can you give us some real-world examples of how AKIDA is revolutionizing AI inference at the edge?

Peter: Automotive is a good place to start. Using AKIDA-powered sensors and accelerators, automotive companies can now design lighter, faster, and more energy efficient in-cabin systems that enable advanced driver verification and customization, sophisticated voice control technology, and next-level gaze estimation and emotion classification capabilities.

Revolutionizing AI inference at the edge In addition to redefining the automotive in-cabin experience, AKIDA is helping enable new computer vision and LiDAR systems to detect vehicles, pedestrians, bicyclists, street signs, and objects with incredibly high levels of precision. We’re looking forward to seeing how these fast and energy efficient ADAS systems help automotive companies accelerate the rollout of increasingly advanced assisted driving capabilities. In the future, we’d also like to power self-driving cars and trucks. But we don’t want to program these vehicles. To achieve true autonomy, cars and trucks must independently learn how to drive in different environmental and topographical conditions such as icy mountain roads with limited visibility, crowded streets, and fast-moving highways.

Enabling advanced LiDAR with AKIDA Neuromorphic AI inference at the edge With AKIDA, these driving skills can be easily copied and adaptable by millions of self-driving vehicles. This is a particularly important point. AKIDA driving updates will be based on real-world knowledge and skills other cars have learned on the road. We want to avoid boilerplate firmware updates pushed out by engineering teams sitting in cubes. A programmed car lacking advanced learning and inferential capabilities can’t anticipate, understand, or react to new driving scenarios. That’s why BrainChip’s AKIDA focuses on efficiently learning, inferring, and adapting new skills.

Q: Aside from automotive, what are some other multimodal edge use cases AKIDA enables?

Peter: Smart homes, automated factories and warehouses, vibration monitoring and analysis of industrial equipment, as well as advanced speech and facial recognition applications. AKIDA is also accelerating the design of robots using sophisticated sensors to see, hear, smell, touch, and even taste.

What is a Neural Network Accelerator?

https://www.fierceelectronics.com/electronics/what-a-neural-network-accelerator

Rise from the ashes

Regular

Azure Virtual Machines with Ampere Altra Arm–based processors—generally available | Microsoft Azure Blog

Microsoft is announcing the general availability of the latest Azure Virtual Machines featuring the Ampere Altra Arm–based processor. The new virtual machines will be generally available on September 1 and customers can now launch them in 10 Azure regions and multiple availability zones around...

azure.microsoft.com

azure.microsoft.com

stuart888

Regular

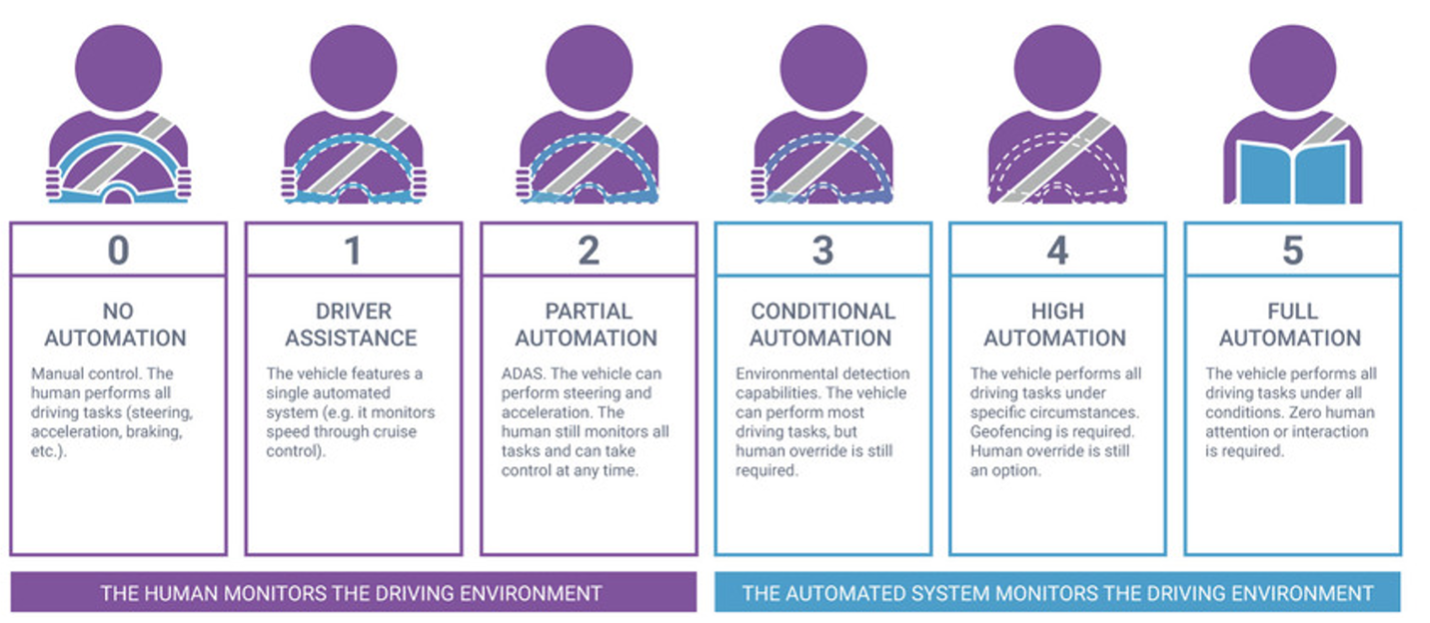

Wow. Perfect thinking! The whole process starts with edge sensor data!In this extract, Paul Karazuba, vice president of marketing at Expedera, discusses power consumption as being the major issue to resolve in terms of reaching L5 full autonomy. He reckons it will require between 1000 to 3000 TOPS for a vehicle to reach Level 5 full autonomy.

We all know that reducing power consumption is right up Aida's alley. I wonder how many AKIDA's would be required to achieve 1000 TOPS hence solving Paul's problem?

EXTRACT

Putting all of these new pieces together takes time, however. Paul Karazuba, vice president of marketing at Expedera, believes much needs to be done to get to full autonomy, starting with much faster and more energy-efficient processing of an enormous amount of streaming data. “Simply from a hardware perspective, the platforms that would be required to deploy L5 in a car don’t exist, and nor do today’s solutions realistically scale to meet L5,” he said. “L5 is going to require a certain amount of AI processing. It’s probably going to be, depending on who you talk to, between 1,000 and 3,000 tera operations per second (TOPS) of processing power. Today’s most advanced solutions for AI processing that one would find in a car is about 250 TOPS.

Fig. 2: The role of artificial intelligence in self-driving vehicles. Source: Expedera

At that level, says Karazuba, the processor consumes about 75 watts of power, which creates significant scaling problems. “If you look at the scaling that’s required, those chips will have to scale by a matter of 4 to 12X in performance, which means the associated scaling of power. Seventy-five watts is about as hot as you can run a chip before you actively need to cool it, and automakers have signaled they have no desire to actively cool electronics in cars because it’s expensive and it adds weight.”

Power constraints

Even if it were possible to scale current solutions to 3,000 TOPS, he said, doing so would consume up to 1% of the battery on one of today’s electric cars. Karazuba said one workaround is putting multiple chips next to one another, but doing so creates both space and cost issues.

“With today’s silicon, you’re talking multiple hundreds of dollars — probably approaching $1,000 per chip — and you’d have four of those in a car, or maybe 12 of those in a car. You also can’t take a chip that’s already pretty darn big and grow it by 4X or 12X. It’s going to have to go to disaggregated processing, either moving processing to multiple places within the car or moving to something like a chiplet model.”

That’s only part of the cost. All of these new features and capabilities require power, and in electric vehicles that power comes from batteries. But battery technology is only improving at a rate of about 5% to 6% per year, while demands for processing more data faster are exploding, creating a gap that widens as more autonomy is added into vehicles.

Where Are The Autonomous Cars?

L5 vehicles need at least 10 more years of development.semiengineering.com

Brainchip SNN is the first-round-draft-pick for edge-sensor-data-smarts!

Similar threads

- Replies

- 0

- Views

- 4K

- Replies

- 9

- Views

- 6K

- Replies

- 0

- Views

- 3K