Cheers mate . It's a forum . Asking questions , even if it's criticism is all part of it . I'm guessing we are all Adults here . I keep up to date with publishings like you do . Anyone can do that . But you have your ear to the ground and have a source of info not privy to rest of us . I understand you cannot divulge your source . That's all good . I appreciate your input . Makes things interesting . So far your intel has mostly been off the mark . Here is my intel just for you : Apparently the ML "will" be issued this week , but because it's the DRC , apparently it "might not" be .You assume a lot. Just because it wasn’t discussed, doesn’t mean it wasn’t known.

Recent conversations revolved around coming out with ML, particularly considering the earlier feedback was “apparently all outstanding issues are sorted” including ownership.

You get some intel and share it on face value. If you are concerned chains are being pulled then treat feedback accordingly.

All the feedback I provide is genuine, and I think this feedback is helpful here when some on social media are making up doom and gloom shit on an hourly basis.

The motivation behind my small efforts are to try and combat the rubbish that’s out there on HC and Twitter for the benefit of the people here, I don’t post my comments on HC or Twitter etc.

You line me up to potentially call foul and make blame, which is a shame. And yes, I’m a poet and I didn’t know it.

Not sure what you want me to say every time you want to question the feedback. I guess all I can say it check your diary and look up the likelihood of doom and gloom before I advised “apparently all issues are sorted” being prior to any public knowledge of the Zijin capitulation and the now accepted public acceptance and understanding that AVZ actually does have the 75% ownership secured.

Can things change after feedback is provided, of course it can.

What was thought to be of no concern and not even mentioned a couple of weeks ago could change into a matter that is now a pain in the ass for AVZ.

So maybe keep all that front of mind when making comments about previous feedback or when drafting your next complaint.

.One last thing to keep in mind and I apologise in advance for this cheesy quote, but we are all in this together.

If you shoot the messenger, guess what happens?……………………….that’s right. No more messenger.

If you feel your circumstances would improve by shooting the messenger, then fire away. I sense you have had an itchy trigger finger for a while.

Or you could find a way to be part of the solution. For example here is a list of some of the newspaper and news websites in the DRC. It takes me many hours a day to review the content in real time two or three times over the 24 hour period looking for AVZ related items.

Feel free to assist. Pick a few of these and let me know you will monitor them. If you are not able to assit that’s fine, it’s just a suggestion.

http://www.abyznewslinks.com/congk.htm (some links have expired)

There are quite a few other sites I visit that are not on this list, particularly the ones suggested a while back by Franck on Twitter.

Like https://econewsrdc.com and I’m subscribed to African Intelligence yet this one is slower to put things to press, yet has better clarity.

To further monitor the DRC press may not be worth worrying about anyway, (at this time) as much everything depends on what the next AVZ announcements have to say.

Cheers The Fox

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

AVZ Discussion 2022

- Thread starter GazDix

- Start date

Agree 100% . A show of confidence . Dathmoir a none issue . Just needs to be sorted . IGF report in hand . Not sure why the Judge needs 2 days to deliberate however .One has to take heed of the subtle clues as well, Nigel strolling around with press and dignitaries perusing potential infrastructure sites to ship some insane amount of product to port must give us hope that all will be sorted in our favour. He would look rather stupid if not.

cheers Dazz!

PS particularly liked the whale shaped pineapple posted a while back.

JAG

Top 20

15%Thanks cruiser! But Jag has sworn me to secrecy and contractually his allaeged 15% (that I still don’t recall signing over) entitles him to all he can drink, a share of the snacks and I’m only allowed to show him how it’s all done…

Operation complete and staying overnight and home tomorrow..

Thanks to everyone’s kind wishes and words!!

TC

Lets go back to the start of our 50/50 business partnership to refresh your memory with more after this clearly outlining the business contractual guidelines we set and agreed upon back in 2021

Rediah

Regular

Only if we can send loads of CMS their way too

www.miningweekly.com

www.miningweekly.com

Goldman says 'buy commodities now, worry about recession later'

Goldman Sachs Group urged investors to pile into commodities as most recession risks coursing through global markets are overblown in the near term, arguing that raw materials stand to rebound amid a profound energy crisis and tight physical fundamentals. “Our economists view the risk of a...

MoneyBags1348

Top 20

Well, I’ve tried using all sorts of foul language tried changing my password to something I can’t remember to get me off these threads, but unfortunately through having spent much of my youth drinking magic mushroom coffee I learned all sorts of ways to overcome roadblocks that even I put in my way. The truth is I want to get off these threads (this forum) but when I see so much confusion I can’t help but try and add some clarity so here’s a few points that I hope help.

Firstly, regarding the ASX200, I’ve put a couple of links below for people here so you can read yourselves rather than taking up a whole lot of room on these threads: The links basically say that any rebalance would have been made in the final week of the month prior to the quarterly rebalance. The rebalance is then announced on the first Friday of the September quarterly rebalance, and takes effect in the third week of the rebalance month.

https://www.spglobal.com/spdji/en//documents/indexnews/announcements/20210902-1443000/1443000_spasxreferencedatemethodologyupdate9-3-2021.pdf

https://advisors.vanguard.com/insights/article/howaremajorindexprovidershandlingupcomingrebalances

https://money.stackexchange.com/questions/115679/how-often-do-the-sp-500-components-change

I think that the rebalance can actually be determined by the funds, meaning the outcome is not necessarily written in stone. Of course, the main issues around all this are that 1) Index Funds are usually aware of what will change and will begin either buying or selling ahead of time and 2) Short sellers may get to make their dirty profits from a sell off.

Firstly, regarding the ASX200, I’ve put a couple of links below for people here so you can read yourselves rather than taking up a whole lot of room on these threads: The links basically say that any rebalance would have been made in the final week of the month prior to the quarterly rebalance. The rebalance is then announced on the first Friday of the September quarterly rebalance, and takes effect in the third week of the rebalance month.

https://www.spglobal.com/spdji/en//documents/indexnews/announcements/20210902-1443000/1443000_spasxreferencedatemethodologyupdate9-3-2021.pdf

https://advisors.vanguard.com/insights/article/howaremajorindexprovidershandlingupcomingrebalances

https://money.stackexchange.com/questions/115679/how-often-do-the-sp-500-components-change

I think that the rebalance can actually be determined by the funds, meaning the outcome is not necessarily written in stone. Of course, the main issues around all this are that 1) Index Funds are usually aware of what will change and will begin either buying or selling ahead of time and 2) Short sellers may get to make their dirty profits from a sell off.

Last edited:

MoneyBags1348

Top 20

Questions regarding our Mining License (PE). There have been questions around CDL and the project extension rights. Firstly CDL is included in PR and therefore the awaiting PE. Unfortunately this map does not show the whole area covered by the PR but it does show the deposits included in the Exploration Permit. Drilling in CDL also provides proof that AVZ has carried out work there

The Mining License may require aspects of ownership to be determined before being approved, but now the Minister of Portfolio has been kicked out, and CAMI is under the direction of the Minister Of Mines (Antoinette) and the Minister of Finance, there should be no issues other than paying for the rights…. My opinion only

Regarding Dathomir, firstly I wouldn’t be expecting news early as the DRC is around 8 hours behind Sydney, so any news might only be the following day.

Secondly, I believe the court case is in Lubumbashi because that is where the original case was held. I also believe the original judge had ties to Kabila and Cong, so a new judge will need to be seen as fair. This is one reason I think the decision will go our way. Apart from this I will post a few of AVZ’s communications around our claim to Dathomir’s 15% in the following post, which is why I believe we will be ok.

Finally, I would like add how disgusted I am at all the foul language I have seen following my previous posts!!

The Mining License may require aspects of ownership to be determined before being approved, but now the Minister of Portfolio has been kicked out, and CAMI is under the direction of the Minister Of Mines (Antoinette) and the Minister of Finance, there should be no issues other than paying for the rights…. My opinion only

Regarding Dathomir, firstly I wouldn’t be expecting news early as the DRC is around 8 hours behind Sydney, so any news might only be the following day.

Secondly, I believe the court case is in Lubumbashi because that is where the original case was held. I also believe the original judge had ties to Kabila and Cong, so a new judge will need to be seen as fair. This is one reason I think the decision will go our way. Apart from this I will post a few of AVZ’s communications around our claim to Dathomir’s 15% in the following post, which is why I believe we will be ok.

Finally, I would like add how disgusted I am at all the foul language I have seen following my previous posts!!

Last edited:

MoneyBags1348

Top 20

24/06/19 AVZ Minerals Limited (ASX: AVZ, “The Company”) is pleased to advise that it has executed a Share Sale Purchase Agreement (“Agreement”) with Dathomir Mining Resources SARL (“Dathomir”) to increase AVZ’s equity in the Manono Lithium and Tin Project (Licence PR13359).

Following ongoing discussions over the last few months, Dathomir has agreed to sell a 5% equity share in Dathcom Mining SAS (“Dathcom”) to AVZ for a total consideration of US$5,500,000. Dathcom holds 100% of the Manono Lithium and Tin Project concession. Under this Agreement, this purchase represents a highly accretive transaction for AVZ shareholders with minimal upfront payment. The first tranche payment of US$500,000 is to be paid within 14 days of execution and the balance of the consideration can be paid at any time within a period of 36 months from execution of the Agreement. At the completion of the transaction, AVZ’s equity interest in the Project licence will increase to 65%, representing an NPV10 value added, based on the recent 5Mtpa Scoping Study1 of some US$130M to approximately US$1.68Bn for AVZ’s 65% equity interest (based on ±35% accuracy and including US$78M in capital contingency).

21/09/20 AVZ Minerals Limited (ASX:AVZ or “the Company”) advises it has executed a Share Sale Purchase Agreement (“Agreement”) for an additional 10% equity stake in Dathcom Mining SA (“Dathcom Mining”) from its joint venture partner, Dathomir Mining Resources SARLU (“Dathomir Mining”). Dathcom Mining holds 100% of the Tier 1 Manono Lithium and Tin Project (“Manono Project”).

Under the Agreement, AVZ has paid US$500,000 to Dathomir Mining as an advance payment. The remaining US$15 M (US$15,000,000) will be paid to Dathomir Mining at any time within 12 months of the Agreement being executed, or as soon as AVZ secures a minimum of US$50 M project financing. Should payment not be made within 12 months of executing the Agreement, AVZ will forego its US$500,000 advance payment and lose the rights to secure the additional 10% equity in the Manono Project.

Alternatively, the Agreement provides for AVZ to secure a minimum 2.5% equity shareholding in Dathcom Mining and thereafter in pro rata amounts up to the maximum 10% stake during the 12-month period.

An Extraordinary General Meeting of Dathcom Mining will need to be convened to approve the sale of Dathomir Mining’s remaining equity in Dathcom Mining to AVZ Minerals. There is no other material terms or condition precedent other than as disclosed above. As previously announced on 24 June 2019, the Company has secured 5% equity interest from Dathomir Mining for a total consideration of US$5,500,000, with an advance payment of US$500,000 made. The balance of the consideration (US$5,000,000) has not yet been paid and can be paid at any time within a period of 36 months from execution of the agreement. Upon completion of both Agreements, AVZ will own 75% of the joint venture company, Dathcom Mining SA (“Dathcom Mining”) – which holds 100% of the Manono Project Licence (PR13359). The remaining 25% of the joint venture company is owned by La Congolaise D’Exploitation Miniere SA (“Cominiere”), of the DRC government. Dathomir Mining will no longer hold equity in the project and, as such, will no longer be required to contribute pro rata to the ongoing operating expenses of the Manono Project.

30/10/20 Activities Report for the Quarter ending 30 September 2020: Highlights

1) Secured rights to additional 10% equity in Manono Lithium and Tin Project for US$15.5M, taking its total ownership to 75% on completion of the transaction

2) Ongoing discussions held to acquire additional equity in the Manono Project

02/07/21 Capital raising Presentation

Ownership before Placement - 60% owned by AVZ Minerals Limited (15% under Option from Dathomir Mining Resources)

21/07/21 Operational Update

Completed $40m capital raising, with funds in part used to increase AVZ’s interest in the Project to 75%

18/08/21 Manono Lithium and Tin Project Corporate Update

Earlier this month, Company representatives met with a high-ranking DRC Government delegation which included senior advisors to the President of Mines & Energy, Ministry of Industry, Ministry of Mines, Ministry of Planning & Ministry of Finance. The delegation provided unanimous support of the Manono Project based on the body of work completed by AVZ, which was submitted to the meeting of multi-sectorial Ministers with the objective of considering the Collaboration Development Agreement between the DRC Government and AVZ. A meeting of the Council of Ministers is scheduled to occur in the coming weeks resulting in a final decision on the Collaboration Development Agreement, which encompasses support of the development of natural resources (mining and transformation industries) and infrastructure (roads, water and electricity). A decision around the proposed MSEZ is expected shortly after finalising the Collaboration Development Agreement, which will require provision of further detailed financial information and investor considerations in the MSEZ.

AVZ continues to enjoy a supportive, collaborative and cooperative working relationship with the DRC Government officials and is highly confident of receiving all necessary permitting and licencing requirements for the Manono Project.

AVZ’s project equity increased to 75% AVZ has increased its interest in the Manono Project from 60% to 75% by exercising the options to purchase Dathomir’s minority shareholding of 15% equity in Dathcom Mining for US$20M (~AUD$27M).

30/09/21

AVZ Minerals Limited Financial Report 30 June 2021

Page 28

Cash Flows from Investing Activities

Payment of deferred consideration - (2,162,731)

Advanced payment to Dathomir (additional 10%) ($685,235)

Page 30

ii. Control over subsidiaries

During 30 June 2017, AVZ Minerals Limited acquired 60% of the issued shares of Dathcom Mining SA (previously known as Dathcom Mining SAS) by the issue of shares and cash. Under the terms of shareholders agreements, the Company is at this stage solely responsible for funding exploration activities and therefore has control over the day-to-day activities and economic outcomes of Dathcom Mining SA. Future changes to the shareholders agreements may impact on the ability of the Company to control Dathcom Mining SA.

Page 39

Notes to the Consolidated Financial Statements for the year ended 30 June 2021

8. Exploration & Evaluation Expenditure

Acquisition of further interest (i) $685,235

(i) On 21 September 2020, AVZ executed a Share Sale Purchase Agreement for an additional 10% equity stake in Dathcom Mining Resources SA from its joint venture partner, Dathomir Mining Resources SARL for US$15.5 million. Under the agreement, AVZ paid US$500,000 in September 2020 to Dathomir as an advance payment, with the remaining US$15M to be paid to Dathomir at any time within 12 months of the Share Sale Purchase Agreement being executed, or as soon as AVZ secures a minimum of US$50 million project financing. Should the payment not be made within 12 months, AVZ will forego its US$500,000 advance payment and lose the rights to secure the additional 10% equity in the Manono Lithium and Tin Project.

The value of the Group’s interest in exploration expenditure is dependent upon:

- The continuance of the Company’s rights to tenure of the areas of interest;

- The results of future exploration; and

- The recoupment of costs through successful development and exploration of the areas of interest, or alternatively, by their sale.

Page 42

13. Financial Liabilities (continued)

On 24 June 2019, the Company announced that it had executed a Share Sale Purchase Agreement (“Agreement”) with Dathomir Mining Resources SARL to increase the Group’s equity in the Manono Lithium and Tin Project for a total consideration of US$5,500,000. Under the Agreement, the first tranche payment of US$500,000 is to be paid within 14 days of execution and the balance of the consideration can be paid at any time within 36 months from execution of the Agreement.

The first tranche payment of US$500,000 was paid in July 2019. The value of the deferred consideration is the board’s assessment of the value of contracted future payments issued under the agreement for the acquisition of Dathcom Mining SA. The fair value is based on assumptions to present value the future payments based on a discount rate of 12%. The principal payments are contractually required in U.S. dollars and have been converted to Australian dollars at 30 June 2021.

Page 50

21. Commitments and Contingencies

On 21 September 2020, AVZ executed a Share Sale Purchase Agreement for an additional 10% equity stake in Dathcom Mining SA from its joint venture partner, Dathomir Mining for US$15.5 million. Under the agreement, AVZ has paid US$500,000 to Dathomir Mining as an advance payment, with the remaining US$15 million committed to be paid to Dathomir Mining at any time within 12 months of the Share Sale Purchase Agreement being executed, or as soon as AVZ secures a minimum of US$50 million project financing. Since the end of the reporting period, AVZ has purchased Dathomir Mining’s 15% shareholding in Dathcom Mining SA (Refer to Note 26). There are no other commitments or contingent liabilities outstanding at the end of the year.

Page 57

26. Events Occurring after the Reporting Date

In July 2021, the Company issued 307,692,308 new shares at $0.13 per share via a share placement to raise $40 million (before costs) from high-quality institutional, sophisticated and professional investors. Proceeds from the placement, increased AVZ’s cash reserve, which allowed the Company to increase its interest in the Manono Project from 60% to 75%. In August 2021, the Company increased its interest in the Manono Project from 60% to 75% by exercising options to purchase Dathomir’s minority shareholding of 15% equity in Dathcom Mining for US$20 million.

29/10/21 AVZ Minerals Limited Annual Report 30 June 2021 AVZ Minerals Limited Annual Report 30 June 2021

Page 4

AVZ secured the rights to an additional 15% equity in the Manono Project – taking our total interest to 75% on completion…..

Page 5

On the corporate front, we completed a highly successful and significantly oversubscribed Share Placement just after the completion of the 2021 Financial Year, which resulted in the Company raising A$40 million (before costs) with funds (in part) used to increase our equity interest in the Manono Project to 75%. The Share Placement was well supported by high-quality institutional investors throughout Australia, Europe, North America, Singapore, Malaysia and the Middle East.

Page 7

Manono Lithium and Tin Project (“Manono Project”) Democratic Republic of Congo (DRC)

Highlights: Secured rights to an additional 10% equity in the Manono Project for US$15.5 million, giving AVZ the option to increase to 75% ownership of the Manono Project on completion of the

Page 13

Review of Operations

Corporate - Equity in Manono Project

In September 2020, AVZ executed a Share Sale Purchase Agreement for an additional 10% equity stake in Dathcom Mining SA (which holds 100% of the Manono Project) from its joint venture partner, Dathomir Mining Resources SARLU (“Dathomir Mining”). Under the Agreement, AVZ paid US$500,000 to Dathomir Mining as an advance payment with the remaining US$15 million to be paid at any time within 12 months of the Agreement being executed or as soon as AVZ secured a minimum US$50 million in project financing. As announced in June 2019, the Company had previously secured a 5% equity interest from Dathomir Mining for a total consideration of US$5.5 million, with an advance payment made of US$500,000. The balance of the consideration (US$5 million) was to be paid at any time within 36 months from execution of the Agreement. AVZ now owns 75% of the joint venture company, Dathcom Mining SA, following completion of both Agreements.* The remaining 25% of Dathcom Mining is owned by La Congolaise d’Exploitation Minière SA (Cominiere), of the DRC Government over which AVZ has a pre-emptive right to purchase further project equity.

Page 14 - Confirmation of Project Ownerships

Page 36

Consolidated Statement of Cash Flows For the Year Ended 30 June 2021

Cash Flows from Investing Activities

Advanced payment to Dathomir (additional 10%) ($685,235)

Page 38

Notes to the Consolidated Financial Statements for the year ended 30 June 2021

1. Summary of Significant Accounting Policies

During 30 June 2017, AVZ Minerals Limited acquired 60% of the issued shares of Dathcom Mining SA (previously known as Dathcom Mining SAS) by the issue of shares and cash. Under the terms of shareholders agreements, the Company is at this stage solely responsible for funding exploration activities and therefore has control over the day-to-day activities and economic outcomes of Dathcom Mining SA. Future changes to the shareholders agreements may impact on the ability of the Company to control Dathcom Mining SA.

Page 58

21. Commitments and Contingencies

On 21 September 2020, AVZ executed a Share Sale Purchase Agreement for an additional 10% equity stake in Dathcom Mining SA from its joint venture partner, Dathomir Mining for US$15.5 million. Under the agreement, AVZ has paid US$500,000 to Dathomir Mining as an advance payment, with the remaining US$15 million committed to be paid to Dathomir Mining at any time within 12 months of the Share Sale Purchase Agreement being executed, or as soon as AVZ secures a minimum of US$50 million project financing. Since the end of the reporting period, AVZ has purchased Dathomir Mining’s 15% shareholding in Dathcom Mining SA (Refer to Note 26). There are no other commitments or contingent liabilities outstanding at the end of the year.

Page 65

26. Events Occurring after the Reporting Date In July 2021, the Company issued 307,692,308 new shares at $0.13 per share via a share placement to raise $40 million (before costs) from high-quality institutional, sophisticated and professional investors. Proceeds from the placement, increased AVZ’s cash reserve, which allowed the Company to increase its interest in the Manono Project from 60% to 75%. In August 2021, the Company increased its interest in the Manono Project from 60% to 75% by exercising options to purchase Dathomir’s minority shareholding of 15% equity in Dathcom Mining for US$20 million.

29/10/21 Activities Report for the Quarter ending 30 September 2021

Completed A$40 million capital raising (before costs)

Exercised options to acquire Dathomir’s 15% shareholding in Dathcom Mining

31/01/22 Activities Report for the Quarter ending 31 December 2021

AVZ raised A$75 million (before costs) supported by leading global institutions and sophisticated investors, including Suzhou CATH Energy Technologies (“CATH”); Raising provides that c.90% of Project capital funding required per the April 2020 DFS* is secured on closure of CATH deal. AVZ announced it would use the funds to: Negotiate the extra 15% equity in Manono from the Government from a strong cash position

Project Funding Discussions Management continued working towards the appointment of a Mandated Lead Arranger (“MLA”) to lead the syndicated debt funding facility for the Manono Project. Subject to closing the deal with CATH, more than 50% of project funding will be secured enabling a Final Investment Decision (“FID”). FID will kickstart project construction and ensure Dathcom will have sufficient equity capital to fund the first 6-8 months of project construction capital, with Financial Close (“FC”) for debt financing expected in Q2 2022. Approximately 90% of Project capital funding required per the April 2020 DFS* will be secured on closure of CATH deal** with AVZ working towards securing further debt funding arrangements for the balance of Project capital required.

16/03/22 AVZ Minerals Limited Interim Financial Report 31 December 2021

Completed a total of A$115 million in capital raisings (before costs); Increased direct interest in the Manono Project from 60% to 75% by exercising options to acquire Dathomir’s 15% shareholding in Dathcom Mining; Progressed discussions with potential financiers for the balance of development capital required for the Manono Project

Page 5

Capital Raising / Project Financing AVZ completed two highly successful, oversubscribed share placements during the period, raising a total of A$115 million (before costs).

In early July 2021, the Company raised A$40 million (before costs) via the issue of 307,692,308 shares at an issue price of $0.13 per share while in early December, the Company raised A$75 million (before costs) via the issue of 150,000,000 shares at an issue price of $0.50 per share. The share placements were well supported by several Tier 1 North American and Australian institutions along with global institutions in Europe, Singapore, Malaysia and the Middle East, as well as existing sophisticated shareholders, including CATH.

Proceeds from the share placements have and will allow AVZ to (i) increase AVZ’s equity in the Manono Project from 60% to 75%

Page 7

Corporate Equity in Manono Project During the period, AVZ increased its direct interest in the Manono Project from 60% to 75% by AVZI exercising the two put options granted by Dathomir Mining Resources SARLU (“Dathomir”); thereby securing Dathomir’s minority 15% shareholding in Dathcom Mining SA (“Dathcom Mining”) for US$20 million (~A$27 million). Replacement share certificates in Dathcom Mining have been awarded and registered at the courts in the DRC.

Page 25

Other than the above, no other matters or circumstances have arisen since the end of the half-year which significantly affected or may significantly affect the operations of the Group, the results of those operations, or the state of affairs in future financial years

Following ongoing discussions over the last few months, Dathomir has agreed to sell a 5% equity share in Dathcom Mining SAS (“Dathcom”) to AVZ for a total consideration of US$5,500,000. Dathcom holds 100% of the Manono Lithium and Tin Project concession. Under this Agreement, this purchase represents a highly accretive transaction for AVZ shareholders with minimal upfront payment. The first tranche payment of US$500,000 is to be paid within 14 days of execution and the balance of the consideration can be paid at any time within a period of 36 months from execution of the Agreement. At the completion of the transaction, AVZ’s equity interest in the Project licence will increase to 65%, representing an NPV10 value added, based on the recent 5Mtpa Scoping Study1 of some US$130M to approximately US$1.68Bn for AVZ’s 65% equity interest (based on ±35% accuracy and including US$78M in capital contingency).

21/09/20 AVZ Minerals Limited (ASX:AVZ or “the Company”) advises it has executed a Share Sale Purchase Agreement (“Agreement”) for an additional 10% equity stake in Dathcom Mining SA (“Dathcom Mining”) from its joint venture partner, Dathomir Mining Resources SARLU (“Dathomir Mining”). Dathcom Mining holds 100% of the Tier 1 Manono Lithium and Tin Project (“Manono Project”).

Under the Agreement, AVZ has paid US$500,000 to Dathomir Mining as an advance payment. The remaining US$15 M (US$15,000,000) will be paid to Dathomir Mining at any time within 12 months of the Agreement being executed, or as soon as AVZ secures a minimum of US$50 M project financing. Should payment not be made within 12 months of executing the Agreement, AVZ will forego its US$500,000 advance payment and lose the rights to secure the additional 10% equity in the Manono Project.

Alternatively, the Agreement provides for AVZ to secure a minimum 2.5% equity shareholding in Dathcom Mining and thereafter in pro rata amounts up to the maximum 10% stake during the 12-month period.

An Extraordinary General Meeting of Dathcom Mining will need to be convened to approve the sale of Dathomir Mining’s remaining equity in Dathcom Mining to AVZ Minerals. There is no other material terms or condition precedent other than as disclosed above. As previously announced on 24 June 2019, the Company has secured 5% equity interest from Dathomir Mining for a total consideration of US$5,500,000, with an advance payment of US$500,000 made. The balance of the consideration (US$5,000,000) has not yet been paid and can be paid at any time within a period of 36 months from execution of the agreement. Upon completion of both Agreements, AVZ will own 75% of the joint venture company, Dathcom Mining SA (“Dathcom Mining”) – which holds 100% of the Manono Project Licence (PR13359). The remaining 25% of the joint venture company is owned by La Congolaise D’Exploitation Miniere SA (“Cominiere”), of the DRC government. Dathomir Mining will no longer hold equity in the project and, as such, will no longer be required to contribute pro rata to the ongoing operating expenses of the Manono Project.

30/10/20 Activities Report for the Quarter ending 30 September 2020: Highlights

1) Secured rights to additional 10% equity in Manono Lithium and Tin Project for US$15.5M, taking its total ownership to 75% on completion of the transaction

2) Ongoing discussions held to acquire additional equity in the Manono Project

02/07/21 Capital raising Presentation

Ownership before Placement - 60% owned by AVZ Minerals Limited (15% under Option from Dathomir Mining Resources)

21/07/21 Operational Update

Completed $40m capital raising, with funds in part used to increase AVZ’s interest in the Project to 75%

18/08/21 Manono Lithium and Tin Project Corporate Update

Earlier this month, Company representatives met with a high-ranking DRC Government delegation which included senior advisors to the President of Mines & Energy, Ministry of Industry, Ministry of Mines, Ministry of Planning & Ministry of Finance. The delegation provided unanimous support of the Manono Project based on the body of work completed by AVZ, which was submitted to the meeting of multi-sectorial Ministers with the objective of considering the Collaboration Development Agreement between the DRC Government and AVZ. A meeting of the Council of Ministers is scheduled to occur in the coming weeks resulting in a final decision on the Collaboration Development Agreement, which encompasses support of the development of natural resources (mining and transformation industries) and infrastructure (roads, water and electricity). A decision around the proposed MSEZ is expected shortly after finalising the Collaboration Development Agreement, which will require provision of further detailed financial information and investor considerations in the MSEZ.

AVZ continues to enjoy a supportive, collaborative and cooperative working relationship with the DRC Government officials and is highly confident of receiving all necessary permitting and licencing requirements for the Manono Project.

AVZ’s project equity increased to 75% AVZ has increased its interest in the Manono Project from 60% to 75% by exercising the options to purchase Dathomir’s minority shareholding of 15% equity in Dathcom Mining for US$20M (~AUD$27M).

30/09/21

AVZ Minerals Limited Financial Report 30 June 2021

Page 28

Cash Flows from Investing Activities

Payment of deferred consideration - (2,162,731)

Advanced payment to Dathomir (additional 10%) ($685,235)

Page 30

ii. Control over subsidiaries

During 30 June 2017, AVZ Minerals Limited acquired 60% of the issued shares of Dathcom Mining SA (previously known as Dathcom Mining SAS) by the issue of shares and cash. Under the terms of shareholders agreements, the Company is at this stage solely responsible for funding exploration activities and therefore has control over the day-to-day activities and economic outcomes of Dathcom Mining SA. Future changes to the shareholders agreements may impact on the ability of the Company to control Dathcom Mining SA.

Page 39

Notes to the Consolidated Financial Statements for the year ended 30 June 2021

8. Exploration & Evaluation Expenditure

Acquisition of further interest (i) $685,235

(i) On 21 September 2020, AVZ executed a Share Sale Purchase Agreement for an additional 10% equity stake in Dathcom Mining Resources SA from its joint venture partner, Dathomir Mining Resources SARL for US$15.5 million. Under the agreement, AVZ paid US$500,000 in September 2020 to Dathomir as an advance payment, with the remaining US$15M to be paid to Dathomir at any time within 12 months of the Share Sale Purchase Agreement being executed, or as soon as AVZ secures a minimum of US$50 million project financing. Should the payment not be made within 12 months, AVZ will forego its US$500,000 advance payment and lose the rights to secure the additional 10% equity in the Manono Lithium and Tin Project.

The value of the Group’s interest in exploration expenditure is dependent upon:

- The continuance of the Company’s rights to tenure of the areas of interest;

- The results of future exploration; and

- The recoupment of costs through successful development and exploration of the areas of interest, or alternatively, by their sale.

Page 42

13. Financial Liabilities (continued)

On 24 June 2019, the Company announced that it had executed a Share Sale Purchase Agreement (“Agreement”) with Dathomir Mining Resources SARL to increase the Group’s equity in the Manono Lithium and Tin Project for a total consideration of US$5,500,000. Under the Agreement, the first tranche payment of US$500,000 is to be paid within 14 days of execution and the balance of the consideration can be paid at any time within 36 months from execution of the Agreement.

The first tranche payment of US$500,000 was paid in July 2019. The value of the deferred consideration is the board’s assessment of the value of contracted future payments issued under the agreement for the acquisition of Dathcom Mining SA. The fair value is based on assumptions to present value the future payments based on a discount rate of 12%. The principal payments are contractually required in U.S. dollars and have been converted to Australian dollars at 30 June 2021.

Page 50

21. Commitments and Contingencies

On 21 September 2020, AVZ executed a Share Sale Purchase Agreement for an additional 10% equity stake in Dathcom Mining SA from its joint venture partner, Dathomir Mining for US$15.5 million. Under the agreement, AVZ has paid US$500,000 to Dathomir Mining as an advance payment, with the remaining US$15 million committed to be paid to Dathomir Mining at any time within 12 months of the Share Sale Purchase Agreement being executed, or as soon as AVZ secures a minimum of US$50 million project financing. Since the end of the reporting period, AVZ has purchased Dathomir Mining’s 15% shareholding in Dathcom Mining SA (Refer to Note 26). There are no other commitments or contingent liabilities outstanding at the end of the year.

Page 57

26. Events Occurring after the Reporting Date

In July 2021, the Company issued 307,692,308 new shares at $0.13 per share via a share placement to raise $40 million (before costs) from high-quality institutional, sophisticated and professional investors. Proceeds from the placement, increased AVZ’s cash reserve, which allowed the Company to increase its interest in the Manono Project from 60% to 75%. In August 2021, the Company increased its interest in the Manono Project from 60% to 75% by exercising options to purchase Dathomir’s minority shareholding of 15% equity in Dathcom Mining for US$20 million.

29/10/21 AVZ Minerals Limited Annual Report 30 June 2021 AVZ Minerals Limited Annual Report 30 June 2021

Page 4

AVZ secured the rights to an additional 15% equity in the Manono Project – taking our total interest to 75% on completion…..

Page 5

On the corporate front, we completed a highly successful and significantly oversubscribed Share Placement just after the completion of the 2021 Financial Year, which resulted in the Company raising A$40 million (before costs) with funds (in part) used to increase our equity interest in the Manono Project to 75%. The Share Placement was well supported by high-quality institutional investors throughout Australia, Europe, North America, Singapore, Malaysia and the Middle East.

Page 7

Manono Lithium and Tin Project (“Manono Project”) Democratic Republic of Congo (DRC)

Highlights: Secured rights to an additional 10% equity in the Manono Project for US$15.5 million, giving AVZ the option to increase to 75% ownership of the Manono Project on completion of the

Page 13

Review of Operations

Corporate - Equity in Manono Project

In September 2020, AVZ executed a Share Sale Purchase Agreement for an additional 10% equity stake in Dathcom Mining SA (which holds 100% of the Manono Project) from its joint venture partner, Dathomir Mining Resources SARLU (“Dathomir Mining”). Under the Agreement, AVZ paid US$500,000 to Dathomir Mining as an advance payment with the remaining US$15 million to be paid at any time within 12 months of the Agreement being executed or as soon as AVZ secured a minimum US$50 million in project financing. As announced in June 2019, the Company had previously secured a 5% equity interest from Dathomir Mining for a total consideration of US$5.5 million, with an advance payment made of US$500,000. The balance of the consideration (US$5 million) was to be paid at any time within 36 months from execution of the Agreement. AVZ now owns 75% of the joint venture company, Dathcom Mining SA, following completion of both Agreements.* The remaining 25% of Dathcom Mining is owned by La Congolaise d’Exploitation Minière SA (Cominiere), of the DRC Government over which AVZ has a pre-emptive right to purchase further project equity.

Page 14 - Confirmation of Project Ownerships

Page 36

Consolidated Statement of Cash Flows For the Year Ended 30 June 2021

Cash Flows from Investing Activities

Advanced payment to Dathomir (additional 10%) ($685,235)

Page 38

Notes to the Consolidated Financial Statements for the year ended 30 June 2021

1. Summary of Significant Accounting Policies

During 30 June 2017, AVZ Minerals Limited acquired 60% of the issued shares of Dathcom Mining SA (previously known as Dathcom Mining SAS) by the issue of shares and cash. Under the terms of shareholders agreements, the Company is at this stage solely responsible for funding exploration activities and therefore has control over the day-to-day activities and economic outcomes of Dathcom Mining SA. Future changes to the shareholders agreements may impact on the ability of the Company to control Dathcom Mining SA.

Page 58

21. Commitments and Contingencies

On 21 September 2020, AVZ executed a Share Sale Purchase Agreement for an additional 10% equity stake in Dathcom Mining SA from its joint venture partner, Dathomir Mining for US$15.5 million. Under the agreement, AVZ has paid US$500,000 to Dathomir Mining as an advance payment, with the remaining US$15 million committed to be paid to Dathomir Mining at any time within 12 months of the Share Sale Purchase Agreement being executed, or as soon as AVZ secures a minimum of US$50 million project financing. Since the end of the reporting period, AVZ has purchased Dathomir Mining’s 15% shareholding in Dathcom Mining SA (Refer to Note 26). There are no other commitments or contingent liabilities outstanding at the end of the year.

Page 65

26. Events Occurring after the Reporting Date In July 2021, the Company issued 307,692,308 new shares at $0.13 per share via a share placement to raise $40 million (before costs) from high-quality institutional, sophisticated and professional investors. Proceeds from the placement, increased AVZ’s cash reserve, which allowed the Company to increase its interest in the Manono Project from 60% to 75%. In August 2021, the Company increased its interest in the Manono Project from 60% to 75% by exercising options to purchase Dathomir’s minority shareholding of 15% equity in Dathcom Mining for US$20 million.

29/10/21 Activities Report for the Quarter ending 30 September 2021

Completed A$40 million capital raising (before costs)

Exercised options to acquire Dathomir’s 15% shareholding in Dathcom Mining

31/01/22 Activities Report for the Quarter ending 31 December 2021

AVZ raised A$75 million (before costs) supported by leading global institutions and sophisticated investors, including Suzhou CATH Energy Technologies (“CATH”); Raising provides that c.90% of Project capital funding required per the April 2020 DFS* is secured on closure of CATH deal. AVZ announced it would use the funds to: Negotiate the extra 15% equity in Manono from the Government from a strong cash position

Project Funding Discussions Management continued working towards the appointment of a Mandated Lead Arranger (“MLA”) to lead the syndicated debt funding facility for the Manono Project. Subject to closing the deal with CATH, more than 50% of project funding will be secured enabling a Final Investment Decision (“FID”). FID will kickstart project construction and ensure Dathcom will have sufficient equity capital to fund the first 6-8 months of project construction capital, with Financial Close (“FC”) for debt financing expected in Q2 2022. Approximately 90% of Project capital funding required per the April 2020 DFS* will be secured on closure of CATH deal** with AVZ working towards securing further debt funding arrangements for the balance of Project capital required.

16/03/22 AVZ Minerals Limited Interim Financial Report 31 December 2021

Completed a total of A$115 million in capital raisings (before costs); Increased direct interest in the Manono Project from 60% to 75% by exercising options to acquire Dathomir’s 15% shareholding in Dathcom Mining; Progressed discussions with potential financiers for the balance of development capital required for the Manono Project

Page 5

Capital Raising / Project Financing AVZ completed two highly successful, oversubscribed share placements during the period, raising a total of A$115 million (before costs).

In early July 2021, the Company raised A$40 million (before costs) via the issue of 307,692,308 shares at an issue price of $0.13 per share while in early December, the Company raised A$75 million (before costs) via the issue of 150,000,000 shares at an issue price of $0.50 per share. The share placements were well supported by several Tier 1 North American and Australian institutions along with global institutions in Europe, Singapore, Malaysia and the Middle East, as well as existing sophisticated shareholders, including CATH.

Proceeds from the share placements have and will allow AVZ to (i) increase AVZ’s equity in the Manono Project from 60% to 75%

Page 7

Corporate Equity in Manono Project During the period, AVZ increased its direct interest in the Manono Project from 60% to 75% by AVZI exercising the two put options granted by Dathomir Mining Resources SARLU (“Dathomir”); thereby securing Dathomir’s minority 15% shareholding in Dathcom Mining SA (“Dathcom Mining”) for US$20 million (~A$27 million). Replacement share certificates in Dathcom Mining have been awarded and registered at the courts in the DRC.

Page 25

Other than the above, no other matters or circumstances have arisen since the end of the half-year which significantly affected or may significantly affect the operations of the Group, the results of those operations, or the state of affairs in future financial years

Last edited:

CeckRaiseFold

Regular

Thanks for an excellent summary of the Dathomir 15% (5% + 10%) Dathcom ownership purchase history of company announcements. Only thing that worries me is that the financial statements (cash-flow) only ever seem to have confirmed the initial 500K option payment even though it is stated that the options were exercised, there does not seem to be a mention of the balance moneys having been paid to secure the 5+10% from Dathomir?24/06/19 AVZ Minerals Limited (ASX: AVZ, “The Company”) is pleased to advise that it has executed a Share Sale Purchase Agreement (“Agreement”) with Dathomir Mining Resources SARL (“Dathomir”) to increase AVZ’s equity in the Manono Lithium and Tin Project (Licence PR13359).

Following ongoing discussions over the last few months, Dathomir has agreed to sell a 5% equity share in Dathcom Mining SAS (“Dathcom”) to AVZ for a total consideration of US$5,500,000. Dathcom holds 100% of the Manono Lithium and Tin Project concession. Under this Agreement, this purchase represents a highly accretive transaction for AVZ shareholders with minimal upfront payment. The first tranche payment of US$500,000 is to be paid within 14 days of execution and the balance of the consideration can be paid at any time within a period of 36 months from execution of the Agreement. At the completion of the transaction, AVZ’s equity interest in the Project licence will increase to 65%, representing an NPV10 value added, based on the recent 5Mtpa Scoping Study1 of some US$130M to approximately US$1.68Bn for AVZ’s 65% equity interest (based on ±35% accuracy and including US$78M in capital contingency).

21/09/20 AVZ Minerals Limited (ASX:AVZ or “the Company”) advises it has executed a Share Sale Purchase Agreement (“Agreement”) for an additional 10% equity stake in Dathcom Mining SA (“Dathcom Mining”) from its joint venture partner, Dathomir Mining Resources SARLU (“Dathomir Mining”). Dathcom Mining holds 100% of the Tier 1 Manono Lithium and Tin Project (“Manono Project”).

Under the Agreement, AVZ has paid US$500,000 to Dathomir Mining as an advance payment. The remaining US$15 M (US$15,000,000) will be paid to Dathomir Mining at any time within 12 months of the Agreement being executed, or as soon as AVZ secures a minimum of US$50 M project financing. Should payment not be made within 12 months of executing the Agreement, AVZ will forego its US$500,000 advance payment and lose the rights to secure the additional 10% equity in the Manono Project.

Alternatively, the Agreement provides for AVZ to secure a minimum 2.5% equity shareholding in Dathcom Mining and thereafter in pro rata amounts up to the maximum 10% stake during the 12-month period.

An Extraordinary General Meeting of Dathcom Mining will need to be convened to approve the sale of Dathomir Mining’s remaining equity in Dathcom Mining to AVZ Minerals. There is no other material terms or condition precedent other than as disclosed above. As previously announced on 24 June 2019, the Company has secured 5% equity interest from Dathomir Mining for a total consideration of US$5,500,000, with an advance payment of US$500,000 made. The balance of the consideration (US$5,000,000) has not yet been paid and can be paid at any time within a period of 36 months from execution of the agreement. Upon completion of both Agreements, AVZ will own 75% of the joint venture company, Dathcom Mining SA (“Dathcom Mining”) – which holds 100% of the Manono Project Licence (PR13359). The remaining 25% of the joint venture company is owned by La Congolaise D’Exploitation Miniere SA (“Cominiere”), of the DRC government. Dathomir Mining will no longer hold equity in the project and, as such, will no longer be required to contribute pro rata to the ongoing operating expenses of the Manono Project.

30/10/20 Activities Report for the Quarter ending 30 September 2020: Highlights

1) Secured rights to additional 10% equity in Manono Lithium and Tin Project for US$15.5M, taking its total ownership to 75% on completion of the transaction

2) Ongoing discussions held to acquire additional equity in the Manono Project

02/07/21 Capital raising Presentation

Ownership before Placement - 60% owned by AVZ Minerals Limited (15% under Option from Dathomir Mining Resources)

21/07/21 Operational Update

Completed $40m capital raising, with funds in part used to increase AVZ’s interest in the Project to 75%

18/08/21 Manono Lithium and Tin Project Corporate Update

Earlier this month, Company representatives met with a high-ranking DRC Government delegation which included senior advisors to the President of Mines & Energy, Ministry of Industry, Ministry of Mines, Ministry of Planning & Ministry of Finance. The delegation provided unanimous support of the Manono Project based on the body of work completed by AVZ, which was submitted to the meeting of multi-sectorial Ministers with the objective of considering the Collaboration Development Agreement between the DRC Government and AVZ. A meeting of the Council of Ministers is scheduled to occur in the coming weeks resulting in a final decision on the Collaboration Development Agreement, which encompasses support of the development of natural resources (mining and transformation industries) and infrastructure (roads, water and electricity). A decision around the proposed MSEZ is expected shortly after finalising the Collaboration Development Agreement, which will require provision of further detailed financial information and investor considerations in the MSEZ.

AVZ continues to enjoy a supportive, collaborative and cooperative working relationship with the DRC Government officials and is highly confident of receiving all necessary permitting and licencing requirements for the Manono Project.

AVZ’s project equity increased to 75% AVZ has increased its interest in the Manono Project from 60% to 75% by exercising the options to purchase Dathomir’s minority shareholding of 15% equity in Dathcom Mining for US$20M (~AUD$27M).

30/09/21

AVZ Minerals Limited Financial Report 30 June 2021

Page 28

Cash Flows from Investing Activities

Payment of deferred consideration - (2,162,731)

Advanced payment to Dathomir (additional 10%) ($685,235)

Page 30

ii. Control over subsidiaries

During 30 June 2017, AVZ Minerals Limited acquired 60% of the issued shares of Dathcom Mining SA (previously known as Dathcom Mining SAS) by the issue of shares and cash. Under the terms of shareholders agreements, the Company is at this stage solely responsible for funding exploration activities and therefore has control over the day-to-day activities and economic outcomes of Dathcom Mining SA. Future changes to the shareholders agreements may impact on the ability of the Company to control Dathcom Mining SA.

Page 39

Notes to the Consolidated Financial Statements for the year ended 30 June 2021

8. Exploration & Evaluation Expenditure

Acquisition of further interest (i) $685,235

(i) On 21 September 2020, AVZ executed a Share Sale Purchase Agreement for an additional 10% equity stake in Dathcom Mining Resources SA from its joint venture partner, Dathomir Mining Resources SARL for US$15.5 million. Under the agreement, AVZ paid US$500,000 in September 2020 to Dathomir as an advance payment, with the remaining US$15M to be paid to Dathomir at any time within 12 months of the Share Sale Purchase Agreement being executed, or as soon as AVZ secures a minimum of US$50 million project financing. Should the payment not be made within 12 months, AVZ will forego its US$500,000 advance payment and lose the rights to secure the additional 10% equity in the Manono Lithium and Tin Project.

The value of the Group’s interest in exploration expenditure is dependent upon:

- The continuance of the Company’s rights to tenure of the areas of interest;

- The results of future exploration; and

- The recoupment of costs through successful development and exploration of the areas of interest, or alternatively, by their sale.

Page 42

13. Financial Liabilities (continued)

On 24 June 2019, the Company announced that it had executed a Share Sale Purchase Agreement (“Agreement”) with Dathomir Mining Resources SARL to increase the Group’s equity in the Manono Lithium and Tin Project for a total consideration of US$5,500,000. Under the Agreement, the first tranche payment of US$500,000 is to be paid within 14 days of execution and the balance of the consideration can be paid at any time within 36 months from execution of the Agreement.

The first tranche payment of US$500,000 was paid in July 2019. The value of the deferred consideration is the board’s assessment of the value of contracted future payments issued under the agreement for the acquisition of Dathcom Mining SA. The fair value is based on assumptions to present value the future payments based on a discount rate of 12%. The principal payments are contractually required in U.S. dollars and have been converted to Australian dollars at 30 June 2021.

Page 50

21. Commitments and Contingencies

On 21 September 2020, AVZ executed a Share Sale Purchase Agreement for an additional 10% equity stake in Dathcom Mining SA from its joint venture partner, Dathomir Mining for US$15.5 million. Under the agreement, AVZ has paid US$500,000 to Dathomir Mining as an advance payment, with the remaining US$15 million committed to be paid to Dathomir Mining at any time within 12 months of the Share Sale Purchase Agreement being executed, or as soon as AVZ secures a minimum of US$50 million project financing. Since the end of the reporting period, AVZ has purchased Dathomir Mining’s 15% shareholding in Dathcom Mining SA (Refer to Note 26). There are no other commitments or contingent liabilities outstanding at the end of the year.

Page 57

26. Events Occurring after the Reporting Date

In July 2021, the Company issued 307,692,308 new shares at $0.13 per share via a share placement to raise $40 million (before costs) from high-quality institutional, sophisticated and professional investors. Proceeds from the placement, increased AVZ’s cash reserve, which allowed the Company to increase its interest in the Manono Project from 60% to 75%. In August 2021, the Company increased its interest in the Manono Project from 60% to 75% by exercising options to purchase Dathomir’s minority shareholding of 15% equity in Dathcom Mining for US$20 million.

29/10/21 AVZ Minerals Limited Annual Report 30 June 2021 AVZ Minerals Limited Annual Report 30 June 2021

Page 4

AVZ secured the rights to an additional 15% equity in the Manono Project – taking our total interest to 75% on completion…..

Page 5

On the corporate front, we completed a highly successful and significantly oversubscribed Share Placement just after the completion of the 2021 Financial Year, which resulted in the Company raising A$40 million (before costs) with funds (in part) used to increase our equity interest in the Manono Project to 75%. The Share Placement was well supported by high-quality institutional investors throughout Australia, Europe, North America, Singapore, Malaysia and the Middle East.

Page 7

Manono Lithium and Tin Project (“Manono Project”) Democratic Republic of Congo (DRC)

Highlights: Secured rights to an additional 10% equity in the Manono Project for US$15.5 million, giving AVZ the option to increase to 75% ownership of the Manono Project on completion of the

Page 13

Review of Operations

Corporate - Equity in Manono Project

In September 2020, AVZ executed a Share Sale Purchase Agreement for an additional 10% equity stake in Dathcom Mining SA (which holds 100% of the Manono Project) from its joint venture partner, Dathomir Mining Resources SARLU (“Dathomir Mining”). Under the Agreement, AVZ paid US$500,000 to Dathomir Mining as an advance payment with the remaining US$15 million to be paid at any time within 12 months of the Agreement being executed or as soon as AVZ secured a minimum US$50 million in project financing. As announced in June 2019, the Company had previously secured a 5% equity interest from Dathomir Mining for a total consideration of US$5.5 million, with an advance payment made of US$500,000. The balance of the consideration (US$5 million) was to be paid at any time within 36 months from execution of the Agreement. AVZ now owns 75% of the joint venture company, Dathcom Mining SA, following completion of both Agreements.* The remaining 25% of Dathcom Mining is owned by La Congolaise d’Exploitation Minière SA (Cominiere), of the DRC Government over which AVZ has a pre-emptive right to purchase further project equity.

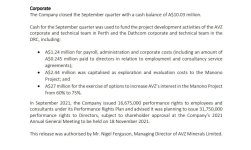

Page 14 - Confirmation of Project Ownerships

View attachment 15397

Page 36

Consolidated Statement of Cash Flows For the Year Ended 30 June 2021

Cash Flows from Investing Activities

Advanced payment to Dathomir (additional 10%) ($685,235)

Page 38

Notes to the Consolidated Financial Statements for the year ended 30 June 2021

1. Summary of Significant Accounting Policies

During 30 June 2017, AVZ Minerals Limited acquired 60% of the issued shares of Dathcom Mining SA (previously known as Dathcom Mining SAS) by the issue of shares and cash. Under the terms of shareholders agreements, the Company is at this stage solely responsible for funding exploration activities and therefore has control over the day-to-day activities and economic outcomes of Dathcom Mining SA. Future changes to the shareholders agreements may impact on the ability of the Company to control Dathcom Mining SA.

Page 58

21. Commitments and Contingencies

On 21 September 2020, AVZ executed a Share Sale Purchase Agreement for an additional 10% equity stake in Dathcom Mining SA from its joint venture partner, Dathomir Mining for US$15.5 million. Under the agreement, AVZ has paid US$500,000 to Dathomir Mining as an advance payment, with the remaining US$15 million committed to be paid to Dathomir Mining at any time within 12 months of the Share Sale Purchase Agreement being executed, or as soon as AVZ secures a minimum of US$50 million project financing. Since the end of the reporting period, AVZ has purchased Dathomir Mining’s 15% shareholding in Dathcom Mining SA (Refer to Note 26). There are no other commitments or contingent liabilities outstanding at the end of the year.

Page 65

26. Events Occurring after the Reporting Date In July 2021, the Company issued 307,692,308 new shares at $0.13 per share via a share placement to raise $40 million (before costs) from high-quality institutional, sophisticated and professional investors. Proceeds from the placement, increased AVZ’s cash reserve, which allowed the Company to increase its interest in the Manono Project from 60% to 75%. In August 2021, the Company increased its interest in the Manono Project from 60% to 75% by exercising options to purchase Dathomir’s minority shareholding of 15% equity in Dathcom Mining for US$20 million.

29/10/21 Activities Report for the Quarter ending 30 September 2021

Completed A$40 million capital raising (before costs)

Exercised options to acquire Dathomir’s 15% shareholding in Dathcom Mining

31/01/22 Activities Report for the Quarter ending 31 December 2021

AVZ raised A$75 million (before costs) supported by leading global institutions and sophisticated investors, including Suzhou CATH Energy Technologies (“CATH”); Raising provides that c.90% of Project capital funding required per the April 2020 DFS* is secured on closure of CATH deal. AVZ announced it would use the funds to: Negotiate the extra 15% equity in Manono from the Government from a strong cash position

Project Funding Discussions Management continued working towards the appointment of a Mandated Lead Arranger (“MLA”) to lead the syndicated debt funding facility for the Manono Project. Subject to closing the deal with CATH, more than 50% of project funding will be secured enabling a Final Investment Decision (“FID”). FID will kickstart project construction and ensure Dathcom will have sufficient equity capital to fund the first 6-8 months of project construction capital, with Financial Close (“FC”) for debt financing expected in Q2 2022. Approximately 90% of Project capital funding required per the April 2020 DFS* will be secured on closure of CATH deal** with AVZ working towards securing further debt funding arrangements for the balance of Project capital required.

16/03/22 AVZ Minerals Limited Interim Financial Report 31 December 2021

Completed a total of A$115 million in capital raisings (before costs); Increased direct interest in the Manono Project from 60% to 75% by exercising options to acquire Dathomir’s 15% shareholding in Dathcom Mining; Progressed discussions with potential financiers for the balance of development capital required for the Manono Project

Page 5

Capital Raising / Project Financing AVZ completed two highly successful, oversubscribed share placements during the period, raising a total of A$115 million (before costs).

In early July 2021, the Company raised A$40 million (before costs) via the issue of 307,692,308 shares at an issue price of $0.13 per share while in early December, the Company raised A$75 million (before costs) via the issue of 150,000,000 shares at an issue price of $0.50 per share. The share placements were well supported by several Tier 1 North American and Australian institutions along with global institutions in Europe, Singapore, Malaysia and the Middle East, as well as existing sophisticated shareholders, including CATH.

Proceeds from the share placements have and will allow AVZ to (i) increase AVZ’s equity in the Manono Project from 60% to 75%

Page 7

Corporate Equity in Manono Project During the period, AVZ increased its direct interest in the Manono Project from 60% to 75% by AVZI exercising the two put options granted by Dathomir Mining Resources SARLU (“Dathomir”); thereby securing Dathomir’s minority 15% shareholding in Dathcom Mining SA (“Dathcom Mining”) for US$20 million (~A$27 million). Replacement share certificates in Dathcom Mining have been awarded and registered at the courts in the DRC.

Page 25

Other than the above, no other matters or circumstances have arisen since the end of the half-year which significantly affected or may significantly affect the operations of the Group, the results of those operations, or the state of affairs in future financial years

Samus

Top 20

Activities Report for the Quarter ending 30 September 2021Thanks for an excellent summary of the Dathomir 15% (5% + 10%) Dathcom ownership purchase history of company announcements. Only thing that worries me is that the financial statements (cash-flow) only ever seem to have confirmed the initial 500K option payment even though it is stated that the options were exercised, there does not seem to be a mention of the balance moneys having been paid to secure the 5+10% from Dathomir?

Activities Report for the Quarter ending 31 December 2021

Unlesss I'm misunderstanding?

Attachments

Xerof

Flushed the Toilet

September 21 cashflow report clearly shows the outflow, under investments. Don't forget it's AUD in the cashflow. The settlement is also mentioned in the commentaryThanks for an excellent summary of the Dathomir 15% (5% + 10%) Dathcom ownership purchase history of company announcements. Only thing that worries me is that the financial statements (cash-flow) only ever seem to have confirmed the initial 500K option payment even though it is stated that the options were exercised, there does not seem to be a mention of the balance moneys having been paid to secure the 5+10% from Dathomir?

Sammael has done a far better job than me

Is there any payments to dathomir in avz financial statements other than the 2 lots of 500,000 for the down payments. As management on several occasions said the cap raises were used to pay for payment of the extra 15% from dathomir. Christ I hope they did make those payments like they said they had. Other wise this could turn into a proper fup. ImoThanks for an excellent summary of the Dathomir 15% (5% + 10%) Dathcom ownership purchase history of company announcements. Only thing that worries me is that the financial statements (cash-flow) only ever seem to have confirmed the initial 500K option payment even though it is stated that the options were exercised, there does not seem to be a mention of the balance moneys having been paid to secure the 5+10% from Dathomir?

JAG

Top 20

P.S I hope your feeling better and the Op went well15%Your doing a "ZIJIN"

Lets go back to the start of our 50/50 business partnership to refresh your memory with more after this clearly outlining the business contractual guidelines we set and agreed upon back in 2021

View attachment 15393

Only if we can send loads of CMS their way too

View attachment 15394

Goldman says 'buy commodities now, worry about recession later'

Goldman Sachs Group urged investors to pile into commodities as most recession risks coursing through global markets are overblown in the near term, arguing that raw materials stand to rebound amid a profound energy crisis and tight physical fundamentals. “Our economists view the risk of a...www.miningweekly.com

Goldman Sachs (GS) has no credibility.

If GS says it's time to buy commodities, then it's time to sell. Then buy a ticket to Phuket and sip Chang until GS says it's time to sell...rinse, repeat.

Cheers

F

CeckRaiseFold

Regular

Thanks for quick reply guys. That should then be a 'simple' case of follow the money to prove ownership.....September 21 cashflow report clearly shows the outflow, under investments. Don't forget it's AUD in the cashflow. The settlement is also mentioned in the commentary

Sammael has done a far better job than me

Can someone care to explain what is being said here? So even after the sale of the 15% to AVZI, Cong was soliciting interests from chinese entities on that same 15%? And what's this offer AVZI made if legitimately own the 15%? I'd be telling Cong to F off.

solo

Regular

.. now the Minister of Portfolio has been kicked out, and CAMI is under the direction of the Minister Of Mines (Antoinette) and the Minister of Finance..

May I please know the source of this information? Thank you.

The part about AVZ "allegedly" making an offer to settle doesn't ring true to me . Under the circumstances of Congs/Dathmoir claims being "without foundation or merit " I really don't see Nigel would have made an offer to settle . That would be counter intuitive . Would give Cong credibility . My take is Nigel initially ignored them , then told them to f--k off .Can someone care to explain what is being said here? So even after the sale of the 15% to AVZI, Cong was soliciting interests from chinese entities on that same 15%? And what's this offer AVZI made if legitimately own the 15%? I'd be telling Cong to F off.

Samus

Top 20

"should" being the operative word here, there is no doubt whatsoever that the money was paid and the deal was done. It's what allgegdly came afterwards is the problem, I'll not go into details for the umpteenth time but my personal opinion is that this is why it's imperative that the supposed court ruling for Dathomir be overturned and above all else. Otherwise how can anybody maintain trust in the congolese judicial system moving forward? Sure it's BS, its BS 100 times over but it's probably the most important aspect of the whole shemozzle. imo.Thanks for quick reply guys. That should then be a 'simple' case of follow the money to prove ownership.....

I'm suprised it's taken this long and hoping the current appeal is actually to finally address it.

Similar threads

- Replies

- 7

- Views

- 4K

- Replies

- 0

- Views

- 2K

- Replies

- 0

- Views

- 2K

- Replies

- 0

- Views

- 2K