You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

PNV Discussion 2022

- Thread starter Lattelarry

- Start date

kickit2me

Member

OK.

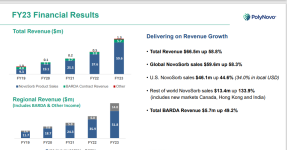

So here is what I get for numbers:

Q4 must be $18.5m BTM sales (to total $59.6m for year as Q1 to Q3 totalled $41.1m) = WELL ABOVE THE $16.2m THE MODEL PREDICTED

June must be $5.8m BTM sales (to total $18.5m for Q4 as April + May was $12.7m) = EXACTLY AS MODEL PREDICTED

BARDA was $5.7m in total = MORE THAN EXPECTED

OTHER is not fully disclosed for the year as in Q3 it was mixed with BARDA. However, its a minimum of $0.5m and yearly total revenue for FY23 is shown as $66.5m so other must be $1.2m in total for FY23.

All in all, a great set of data.

Now to add this data in and adjust the models for FY24 predictions.

So here is what I get for numbers:

Q4 must be $18.5m BTM sales (to total $59.6m for year as Q1 to Q3 totalled $41.1m) = WELL ABOVE THE $16.2m THE MODEL PREDICTED

June must be $5.8m BTM sales (to total $18.5m for Q4 as April + May was $12.7m) = EXACTLY AS MODEL PREDICTED

BARDA was $5.7m in total = MORE THAN EXPECTED

OTHER is not fully disclosed for the year as in Q3 it was mixed with BARDA. However, its a minimum of $0.5m and yearly total revenue for FY23 is shown as $66.5m so other must be $1.2m in total for FY23.

All in all, a great set of data.

Now to add this data in and adjust the models for FY24 predictions.

kickit2me

Member

We know its either lack of understanding and realism from retail investors, or the share price being manipulated.

In the medium term. Analysts will do exactly as I have done with the numbers (esp Macquarie who seem to be doing the same modelling) and come up with the fact that these results exceed projections of previous models.

They will do exactly as I am about to do, adjust the models to include this data, and come up with increased projections - and an increased nominal share price.

All good.

I will get back with revised projections for the future ASAP.

In the medium term. Analysts will do exactly as I have done with the numbers (esp Macquarie who seem to be doing the same modelling) and come up with the fact that these results exceed projections of previous models.

They will do exactly as I am about to do, adjust the models to include this data, and come up with increased projections - and an increased nominal share price.

All good.

I will get back with revised projections for the future ASAP.

Lattelarry

Regular

Thanks really good info as per usual. Interested to see what the model is now predicting.OK.

So here is what I get for numbers:

Q4 must be $18.5m BTM sales (to total $59.6m for year as Q1 to Q3 totalled $41.1m) = WELL ABOVE THE $16.2m THE MODEL PREDICTED

June must be $5.8m BTM sales (to total $18.5m for Q4 as April + May was $12.7m) = EXACTLY AS MODEL PREDICTED

BARDA was $5.7m in total = MORE THAN EXPECTED

OTHER is not fully disclosed for the year as in Q3 it was mixed with BARDA. However, its a minimum of $0.5m and yearly total revenue for FY23 is shown as $66.5m so other must be $1.2m in total for FY23.

All in all, a great set of data.

Now to add this data in and adjust the models for FY24 predictions.

I've been looking through the report for things not to like and so far the only things I have is that India is barely mentioned so there must not be many sales yet, probably under what they were hoping.

Also hernia and the next product pillar aren't given much detail so I guess they won't have that ready this FY unfortunately.

I thought SR was going to push these 2 a lot as it's an obvious way of boosting sales way beyond current trend, which I'm sure he is looking to do.

kickit2me

Member

OK.

So here is what I get for numbers:

Q4 must be $18.5m BTM sales (to total $59.6m for year as Q1 to Q3 totalled $41.1m) = WELL ABOVE THE $16.2m THE MODEL PREDICTED

June must be $5.8m BTM sales (to total $18.5m for Q4 as April + May was $12.7m) = EXACTLY AS MODEL PREDICTED

BARDA was $5.7m in total = MORE THAN EXPECTED

OTHER is not fully disclosed for the year as in Q3 it was mixed with BARDA. However, its a minimum of $0.5m and yearly total revenue for FY23 is shown as $66.5m so other must be $1.2m in total for FY23.

All in all, a great set of data.

Now to add this data in and adjust the models for FY24 predictions.

Shit - just found all of my calculations confirmed in a single chart ... no matter.

Attachments

Hi kickEnded up gardening all arvo

Will get them today for tomorrow. Am working on them now.

...

Ihabe found the following in todays the Australian article

Wilsons analyst Shane Storey downgraded the company to underweight in May and has maintained that rating after it flagged that US sales of its NovoSorb BTM product were slowing, which he described as a “red flag” at the time.

Have you noticed any slowdown in your analysis ? I know that for some reason they put the US sales in US$ and they did look low....but is it a developing trend?

kickit2me

Member

High @basiacHi kick

Ihabe found the following in todays the Australian article

Wilsons analyst Shane Storey downgraded the company to underweight in May and has maintained that rating after it flagged that US sales of its NovoSorb BTM product were slowing, which he described as a “red flag” at the time.

Have you noticed any slowdown in your analysis ? I know that for some reason they put the US sales in US$ and they did look low....but is it a developing trend?

I haven't analysed the US data on its own, so am not aware if this is correct from the Wilson's analyst. Even it it is, I'd consider it to be nitpicking. Overall rate of growth of BTM sales continues to accelerate.

kickit2me

Member

Done - see post below ...Any updates on your sales projection graphs Kickit?

kickit2me

Member

Projection variations from modelling new data:

Using the model that is fitted to monthly data from inception:

Adding in final Q4FY23 data

Old rate of change: 0.0252

New rate of change: 0.0258

i.e. The rate of growth has accelerated - again - marginally

Old projected BTM sales for FY24 was $78m

New projected BTM sales for FY24 is $79m

New projected BTM sales for FY25 is $103m

New projected BTM sales for Q1FY24 is $18m

i.e. Showing the marginal improvement on rate of growth that Q4FY23 data indicates

Using the model that is fitted to monthly data since Jan 2021

New projected BTM sales for FY24 is $90m

New projected BTM sales for FY25 is $128m

New projected BTM sales for Q1FY24 is $19m

Summary:

1. The rate of growth of growth is still showing an acceleration.

2. Q4FY23 gave only a marginal increase

3. The "since inception" model is a good baseline to check future data against

4. The "since 2021" model is a good upper limit for your imagination

5. Reminder this is only BTM (product) sales and does not include BARDA (also growing) and OTHER.

Using the model that is fitted to monthly data from inception:

Adding in final Q4FY23 data

Old rate of change: 0.0252

New rate of change: 0.0258

i.e. The rate of growth has accelerated - again - marginally

Old projected BTM sales for FY24 was $78m

New projected BTM sales for FY24 is $79m

New projected BTM sales for FY25 is $103m

New projected BTM sales for Q1FY24 is $18m

i.e. Showing the marginal improvement on rate of growth that Q4FY23 data indicates

Using the model that is fitted to monthly data since Jan 2021

New projected BTM sales for FY24 is $90m

New projected BTM sales for FY25 is $128m

New projected BTM sales for Q1FY24 is $19m

Summary:

1. The rate of growth of growth is still showing an acceleration.

2. Q4FY23 gave only a marginal increase

3. The "since inception" model is a good baseline to check future data against

4. The "since 2021" model is a good upper limit for your imagination

5. Reminder this is only BTM (product) sales and does not include BARDA (also growing) and OTHER.

Lattelarry

Regular

Thanks will be interesting to see how it plays out over the next year.Projection variations from modelling new data:

Using the model that is fitted to monthly data from inception:

Adding in final Q4FY23 data

Old rate of change: 0.0252

New rate of change: 0.0258

i.e. The rate of growth has accelerated - again - marginally

Old projected BTM sales for FY24 was $78m

New projected BTM sales for FY24 is $79m

New projected BTM sales for FY25 is $103m

New projected BTM sales for Q1FY24 is $18m

i.e. Showing the marginal improvement on rate of growth that Q4FY23 data indicates

Using the model that is fitted to monthly data since Jan 2021

New projected BTM sales for FY24 is $90m

New projected BTM sales for FY25 is $128m

New projected BTM sales for Q1FY24 is $19m

Summary:

1. The rate of growth of growth is still showing an acceleration.

2. Q4FY23 gave only a marginal increase

3. The "since inception" model is a good baseline to check future data against

4. The "since 2021" model is a good upper limit for your imagination

5. Reminder this is only BTM (product) sales and does not include BARDA (also growing) and OTHER.

Also given the price rise that will also give a bump to the numbers.

Lattelarry

Regular

What did your model predict would be sales for FY23? I think it was on the old website.There is also a predicted continuation of the fall of the AUD exchange rate due to China's issues - so we may get an unplanned bonus in all of our revenues next year.

...

Thanks

kickit2me

Member

I hadn't been keeping records of that type of data so had to crawl back through my notes.What did your model predict would be sales for FY23? I think it was on the old website.

Thanks

Looks like; (From Qrtly model)

Projected FY23:

At end of FY22 = $51m

At end of Q1FY23 = $54m

At end of Q2FY23 = $56m

At end of Q3FY23 = $58

Each time new data is added (qrtly) the model resets to fit all data including the new data.

This spiralling upward effect is what we are looking for, and for it to keep increasing its rate of growth, as it has been. We want the numbers to keep outpacing the model as it is fitted to old data. So, not just bigger numbers, but increases bigger relatively than the last increase. That's acceleration.

Remembering these numbers are only BTM (product) sales, the most recent projection was $58m and the actual was $59.6.

Lattelarry

Regular

CheersI hadn't been keeping records of that type of data so had to crawl back through my notes.

Looks like; (From Qrtly model)

Projected FY23:

At end of FY22 = $51m

At end of Q1FY23 = $54m

At end of Q2FY23 = $56m

At end of Q3FY23 = $58

Each time new data is added (qrtly) the model resets to fit all data including the new data.

This spiralling upward effect is what we are looking for, and for it to keep increasing its rate of growth, as it has been. We want the numbers to keep outpacing the model as it is fitted to old data. So, not just bigger numbers, but increases bigger relatively than the last increase. That's acceleration.

Remembering these numbers are only BTM (product) sales, the most recent projection was $58m and the actual was $59.6.

I was interested in end of FY22 - which is a big change from 51 to 59.6 (as you say)

Yes I was interested to see how the numbers were outstripping the model to see the acceleration.

Also interesting that even by Q3 the growth still outstripped the model by a fair bit.

If you dont mind 1 other question. If you limit the model to just 2023 data what does it predict for FY24 sales?

kickit2me

Member

Doing that I used monthly values to get enough data and it projects FY24 to be $105m!Cheers

I was interested in end of FY22 - which is a big change from 51 to 59.6 (as you say)

Yes I was interested to see how the numbers were outstripping the model to see the acceleration.

Also interesting that even by Q3 the growth still outstripped the model by a fair bit.

If you dont mind 1 other question. If you limit the model to just 2023 data what does it predict for FY24 sales?

(Of course it reduces the fit of the model to r^2 = 0.45 - i.e, much less reliable)

(With all data its r^=0.9584. With 2021 onwards data its r^2 = 0.9566 (surprisingly just less than all data!)

Lattelarry

Regular

Great thanks - it will be interesting to see in 12 months time which was the closest

kickit2me

Member

I see the model now as having two main purposes:Great thanks - it will be interesting to see in 12 months time which was the closest

- Setting a lower limit for the sales data to check new data against

- Giving an opportunity to monitor rate of growth - are we just growing or accelerating?

Similar threads

- Replies

- 0

- Views

- 674

- Replies

- 0

- Views

- 1K

- Replies

- 0

- Views

- 602

- Replies

- 0

- Views

- 540