Lex555

Regular

And what the minimum amount of our next 4C will be, if payment terms are 90 daysyes I think you’re right, they probably had $3.4m in receivables. Which if correct shows how much revenue is escalating

And what the minimum amount of our next 4C will be, if payment terms are 90 daysyes I think you’re right, they probably had $3.4m in receivables. Which if correct shows how much revenue is escalating

Me again,

Inspector Bravo reporting for dot-joining duty!

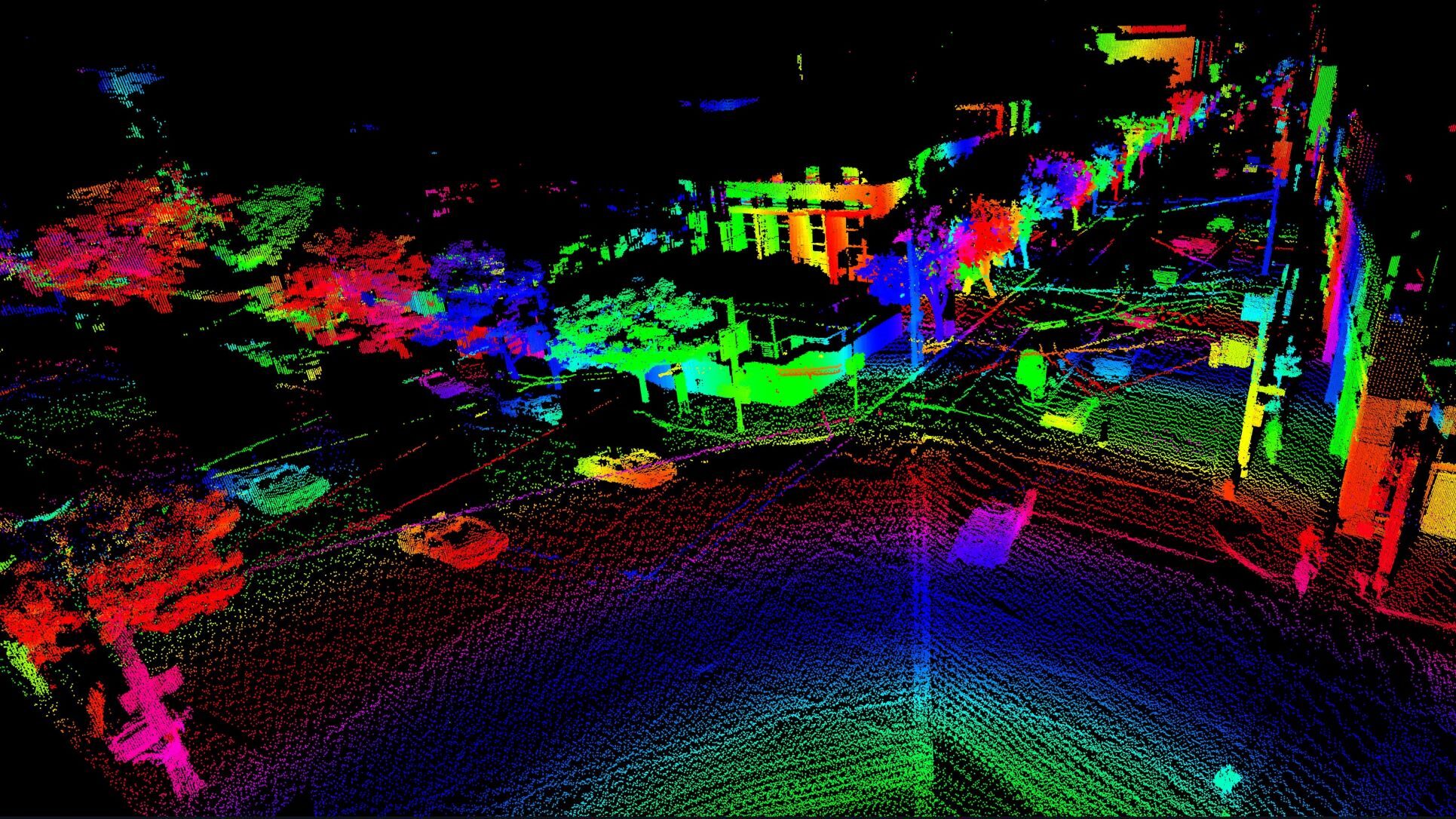

Something I'm currently perusing is this recent announcement from AEye Inc who are teaming up with Booz Allen Hamilton to drive the adoption of AEye’s technology for aerospace and defense applications/DOD requirements. They are talking about applications "that must be able to see, classify, and respond to an object in real-time, at high speeds, and long distances". They mention technology like artificial intelligence (AI), machine learning (ML), and edge computing as well as embedded sensors that are capable of long-range detection, exceeding one kilometer, are flexible enough to track a bullet at 25,000 frames per second, and can either cue off of other sensors or self-cue, subsequently adapting to place high-density regions of interest around targets". The new long range LiDAR technology looks particularly interesting.

I looked at AEye's website and can see that they're working with NVDIA and with the NVDIA DRIVE autonomous vehicle platform (circled below). It also says "selected by Continental, one of the world’s largest automotive suppliers, as their high-performance sensor with volume production starting in 2024".

If you check out this other article linked below it talks about AEye's CTO who is Luis Dussan "previously a leading technologist at Lockheed Martin and Northrop Grumman responsible for designing mission-critical targeting systems for fighter jets. Dussan realized that a self-driving car faces a similar challenge; it must be able to see, classify, and respond to an object—whether it’s a parked car or a child crossing the street—in real-time and before it’s too late. He helped build the AEye team of scientists and electro-optics engineers from NASA, Lockheed, Northrop, the U.S. Air Force, and DARPA to create a high-performance sensing and perception system to ensure the highest levels of safety for autonomous driving".

Suffice to say, there is a lot of interesting information here which might indicate the use of neuromorphic sensors but I'll need to keep digging to see if I hit either an almighty, tsunami-like water spout or else a dried up ancient burial ground with skeletons piled up in the corner and not a drop of moisture to be found for love or money. Obviously I'm hoping it will be the former option but I'll keep you posted.

B x

AEye joins hands with Booz Allen to advance Lidar in Aerospace and Defense

By

News Desk

-

08/19/2022 2 Minutes Read

AEye, Inc, a global leader in adaptive, high-performance lidar solutions, today announced a partnership with Booz Allen Hamilton, one of the Department of Defense’s premier digital system integrators and a leader in data-driven artificial intelligence, to productize and drive the adoption of AEye’s technology for aerospace and defense (A&D) applications.

With the accelerated activity in these markets, the company also announced the opening of an office in Florida’s “Space Coast” region, and the hiring of veteran defense systems engineering leader Steve Frey, a Lockheed Martin and L3Harris Technologies alum, as its vice president of business development for A&D.

AEye and Booz Allen Collaborate on AI-Driven Defense Solutions

“Aerospace and defense applications must be able to see, classify, and respond to an object in real-time, at high speeds, and long distances. AEye’s 4Sight™ software-definable lidar system, with its adaptive sensor-based operating system, uniquely meets these challenging demands,” said Blair LaCorte, CEO of AEye. “We are collaborating with Booz Allen Hamilton to optimize its real-time embedded processor perception stack. This aligns with Booz Allen’s digital battlespace vision for an information-driven, fully integrated conflict space extending across all warfighting domains, enabled by technology like artificial intelligence (AI), machine learning (ML), and edge computing to realize information superiority and achieve overmatch.”

Booz Allen has developed a client toolkit for assessing the performance of machine learning and artificial intelligence, fusing data from multiple sensors – including lidar, camera, and radar – and virtualizing perception data for optimized mapping onto embedded processors to fully support situational awareness for the military. This toolkit accelerates AEye’s 4Sight Intelligent Sensing Platform time-to-market in the Aerospace & Defense markets.

“Information warfare will drive tomorrow’s battles, and wars will be won by those who maintain superior situational awareness provided by critical technologies like AI and ML,” said Dr. Randy M. Yamada, Booz Allen vice president and a leader in the firm’s defense solutions portfolio. “Given this, AI must not be an afterthought, but rather a solution that can keep up with the challenging demands of DOD requirements. Booz Allen will enable AEye’s adaptive, software-defined architecture that greatly expands the utility of AI and ML for defense applications, which we believe will be a game-changer.”

AEye’s 4Sight sensors are capable of long-range detection, exceeding one kilometer, are flexible enough to track a bullet at 25,000 frames per second, and can either cue off of other sensors or self-cue, subsequently adapting to place high-density regions of interest around targets. These capabilities, enabled by 4Sight’s in-sensor perception, greatly expand the utility of AI and ML for defense applications and, ultimately, save lives.

Beyond defense, there are many types of applications that require a real-time transformation of raw data into actionable information. As such, AEye plans to leverage the perception stack advancements being developed in conjunction with Booz Allen into various edge computing environments with its automotive and industrial customer base.

View attachment 14652 View attachment 14654

View attachment 14655

View attachment 14656 View attachment 14657

AEye joins hands with Booz Allen to advance Lidar in Aerospace and Defense

AEye Inc, has announced a partnership with Booz Allen Hamilton to productize and drive the adoption of AEye’s tech for Aerospace and Defense.www.geospatialworld.net

AEye demonstrates adaptive lidar to enhance software-defined vehicles

Its 4Sight platform, shown at AutoSens Detroit, can be modified for any vehicle application, increasing adoption and deployment across OEM platforms and reducing engineering costs by enabling OEMs to embed the same lidar sensor in multiple locations using its proprietary sensing software.futurride.com

I think the growth will be exponentialyes I think you’re right, they probably had $3.4m in receivables. Which if correct shows how much revenue is escalating

I remember what excitement there was when the last 4C showed revenue just in excess of 1M and how it caused a nice spike in the SP. Makes today's SP action hard to fathom.yes I think you’re right, they probably had $3.4m in receivables. Which if correct shows how much revenue is escalating

opening debtors 100K (note 9)

plus revenue 4.8M (this is 6 month revenue? if so i fukdup earlier i thought it was 12 months)

less closing debtors 2.5M

=cash

=2.4M

but you are right, there appears to be a $1M gap?

ill need to read back through to make sure i aint missed something....

Shorters in panic mode!!?? Knowing BRN are gaining tractionI remember what excitement there was when the last 4C showed revenue just in excess of 1M and how it caused a nice spike in the SP. Makes today's SP action hard to fathom.

Good point on service revenue doubling, this can be seen as a forward indicator for revenue, so a chance receivables will double tooI think the growth will be exponential

For me, this report means a lot...

Given our technology is validated already, I just wanted further assurance that it's actually marketable (not for research but real $$$)... and I can also see the revenue from providing service has also nearly doubled which I see it as more customer engagements for product development/ integration...

And how wrong everyone was. That wasn't the actual revenue figure for the qtr. Just the cash receipts from previous revenue. Could have been from last year.I remember what excitement there was when the last 4C showed revenue just in excess of 1M and how it caused a nice spike in the SP. Makes today's SP action hard to fathom.

And how wrong everyone was. That wasn't the actual revenue figure for the qtr. Just the cash receipts from previous revenue. Could have been from last year.

The only thing we do know is the revenue for the last 6 months is $4.8m which is the only figure we need to concentrate on. Which also means the 4c's don't really tell us much about revenue unless cash receipts from customers has jumped significantly higher than the last 6 month reported revenue figure.

Not sure what's happening @Bravo but my pants have gone tight? and a wet spot has appeared.Hey Team,

Check this out! I'd been meaning to follow up on my previous speculations (shhhh..please don't tell @uiux that I was speculating) about any possible connections we may have with AEye and I was just flicking through some of their investor information and I came across this Leadership Team slide. And what caught my attention, a bit like a brick falling unexpectedly out of the sky and hitting me on my noodle, was that the team consists of a person called Bernd Reichert.

Now if you look a little closer at Bernd you will discover that he used to work at Valeo. And if you dig a little deeper (as I most assuredly did), I discoverd he was appointed by AEye from Valeo on 27 July 2021 as Senior Vice President of ADAS. Leaving no stone unturned I then looked for the announcement of Bernd's appointment and discovered some information that is making feel a teensy bit excited (excited is actually a MASSIVE understatement but don't tell U-bby I said that)!

Anyway I have underlined some information that I think you might find interesting and I will leave it to all of you, my brainiac friends from far and wide, to draw your own conclusions.

B

View attachment 14846

View attachment 14850

View attachment 14852

AEye Appoints Bernd Reichert to Executive Team as Senior Vice President of ADAS

AEye brings on former Valeo VP to drive penetration of AEye LiDAR in automotive and commercial trucking sectorswww.businesswire.com

To be honest, I was also shocked, but IMO it will go back up soon and hopefully it will go back to at least $1.20 level and perhaps higher if we get more announcementsVery Very frustrating to see most of the market green and brainchip down. When will these shorters or accumulators let it go and rise.

So everyone has been around the bush to come back to where I was above.This is correct.

Based on past releases about $2 million OF the $4.8 million is unexplained and attributable predominately to licence fees.

As $2 million is a substantial amount if it has arisen from a licence/s for AKIDA technology directly entered by Brainchip with a customer/s there is no NDA known to man that would sideline the obligation of Brainchip to make a price sensitive announcement on the ASX. There has been no announcement ask Rocket if you want confirmation of this fact.

Logic therefore suggests that MegaChips is the most likely source of this additional licence fee or fees as its agreement allowed for it to sell licences of the AKIDA IP.

The unknown is how many licences and who are the customers.

We know Renesas paid around $500,000 to licence 2 nodes of AKIDA IP.

We know MegaChips paid somewhere from $1.5 million to $2 million for a full AKD1000 IP licence.

As AKIDA IP is scalable in this fashion then the $2 million could be four (4x) sales of $500,000 or one (1x) sale of $2 million.

However we need to remember MegaChips is providing all the resources to achieve the sale and service the customers so they must be receiving a fee or a percentage of each licence they sell. We have not been given the details of this financial arrangement.

So if they are receiving fifty percent of the fee to cover their services and remitting the balance to Brainchip then the potential customer payments remitted rise to eight x $250,000 or two x $1 million or other combinations thereof.

These numbers are based on logic and fact nothing more but in my opinion need to be considered seriously in assessing the potential significance of this report.

My opinion only DYOR

FF

AKIDA BALLISTA

Thankyou for coming back Fact. Whilst we don't NEED you to post, you do have a way with words and a knack for simplification.So everyone has been around the bush to come back to where I was above.

There was an unexpected additional 2 million dollars in revenue which the Company tells us in the half yearly report is primarily achieved from additional licence fees.

I have stated my opinion on where these licence fees could come from in the above post.

For those who do not remember it was disclosed by MegaChips that they had spent time before the IP agreement was finalised to train their engineering staff so that they could completely service their customer base with the design and implementation of AKIDA IP.

Big tick number one to Brainchip as this releases Brainchip engineers for other things and does not require additional staff and the associated on costs.

MegaChips far from shuffling papers has taken on the role of advertising and promoting AKIDA to its long established customer base which includes Nintendo and Sanyo thereby lending their credibility to the AKIDA IP a hugely valuable commodity for a startup from Australia selling revolutionary one of a kind technology in competition with the likes of Nvidia, Intel and IBM.

Second tick for Brainchip no cost associated with this or any need to deploy staff as MegaChips are doing it all.

My suggestion that MegaChips might be receiving fifty percent of the licence fee for doing all the above is perfectly reasonable, in fact as the real money is, as stated by Brainchip, to be made from the ongoing royalties I could easily make out a case that giving MegaChips the full licence fee is a great deal if they end up delivering Nintendo and Sanyo.

As for why it is a given that Brainchip would have to announce the IP licence/s if they entered them directly with the customer I would say that to an experienced investor this is obvious because the ASX rules require material agreements to be announced to the market.

Material relates to the particular company’s situation.

The CBA signing a contract for $2 million is not material to its billion dollar bottom line. In fact it would probably not even pay for the tea and coffee for staff each quarter and as such clearly would not move shareholder sentiment or affect CBA’s share price.

Where a company like Brainchip is concerned however a $2 million IP licence/s being close to half of its first half year revenue is obviously material no ‘ifs buts or maybes’. As such no getting around it it would have to be announced.

My opinion only DYOR

FF

AKIDA BALLISTA

It says statement of cash flows so I would guess not…There is a $3.4m dollar gap between the reported revenue of the last two 4c's and the half yearly.

from the last 4c - receipts from customers. Do they include accruals in the 4c's

View attachment 14842

It's not hard to fathom at all, mcm..I remember what excitement there was when the last 4C showed revenue just in excess of 1M and how it caused a nice spike in the SP. Makes today's SP action hard to fathom.

Perhaps the market just needs a more obvious indication of what AKIDA can do. For us it's a great report but for those who know nothing about the technology it'll take a customer announcement to wake up the masses. I think this is still too 'speculative' for most. To avoid frustration it's best to understand that we see into the future through the 1000 eyes, others (most) aren't as privileged.I've been gobsmacked all day that such a positive report could have such an impact on the ASX today and why. Alas, I'm no further advance to a suggestion.

I'm hopeful of a big green day for us tomorrow, after the oversea's markets get their chance tonight, which in turn spurs on a frenzy of activity tomorrow, with the shorters having to buy back in, in a hurry.

thanks @Bravo, interesting man, this Bernd Reichert, of course I had to look at him right away and found him applaudingHey Team,

Check this out! I'd been meaning to follow up on my previous speculations (shhhh..please don't tell @uiux that I was speculating) about any possible connections we may have with AEye and I was just flicking through some of their investor information and I came across this Leadership Team slide. And what caught my attention, a bit like a brick falling unexpectedly out of the sky and hitting me on my noodle, was that the team consists of a person called Bernd Reichert.

Now if you look a little closer at Bernd you will discover that he used to work at Valeo. And if you dig a little deeper (as I most assuredly did), I discoverd he was appointed by AEye from Valeo on 27 July 2021 as Senior Vice President of ADAS. Leaving no stone unturned I then looked for the announcement of Bernd's appointment and discovered some information that is making feel a teensy bit excited (excited is actually a MASSIVE understatement but don't tell U-bby I said that)!

Anyway I have underlined some information that I think you might find interesting and I will leave it to all of you, my brainiac friends from far and wide, to draw your own conclusions.

B

View attachment 14846

View attachment 14850

View attachment 14852

AEye Appoints Bernd Reichert to Executive Team as Senior Vice President of ADAS

AEye brings on former Valeo VP to drive penetration of AEye LiDAR in automotive and commercial trucking sectorswww.businesswire.com