Fullmoonfever

Top 20

Nice to see Tata Elxsi still on the neuromorphic train.

ai.tataelxsi.com

ai.tataelxsi.com

MULTIMODAL AI AND NEUROMORPHIC AI: DETECTION, DIAGNOSIS, PROGNOSIS

The synergy of cutting-edge technologies like Multimodal and Neuromorphic AI signals a pivotal shift from reactive to proactive healthcare. This article explores captivating use cases, offering insights on the implementation of Responsible AI.

Join us as we navigate the frontier of healthcare, where the synergy of innovation and responsibility promises a revolution in patient care and well-being.

The tides are changing as the healthcare sector recognises the urgency for an interdisciplinary approach, marrying engineering with medical science. This paradigm shift signals an imminent era where AI’s vast capabilities will revolutionise diagnostics, patient treatment, protocols, drug development and delivery, and prescription practices over the next decade.

Join us as we navigate the frontier of healthcare, where the synergy of innovation and responsibility promises a revolution in patient care and well-being.

These technologies hold promise to transform healthcare by enhancing diagnostics, enabling personalised medicine, predicting long-term prognosis and contributing to innovations in therapeutic interventions.

Let’s delve into compelling use cases and glimpse the future of preventive healthcare.

The tides are changing as the healthcare sector recognises the urgency for an interdisciplinary approach, marrying engineering with medical science. This paradigm shift signals an imminent era where AI’s vast capabilities will revolutionise diagnostics, patient treatment, protocols, drug development and delivery, and prescription practices over the next decade.

Join us as we navigate the frontier of healthcare, where the synergy of innovation and responsibility promises a revolution in patient care and well-being.

This innovative approach provides critical diagnostic information for musculoskeletal injuries, including tissue damage extent, recovery progress, and healing time predictions, all with enhanced efficiency and device portability making it ideal for applications such as sports medicine.

While Advanced AI Technologies offer the potential for improvising the use cases, the application of MLOps can be instrumental in strengthening and regulating these advancements. It achieves this by bringing in streamlined AI development processes, dataset management, continuous monitoring of model accuracy across different versions, ensuring the deployment of thoroughly vetted versions for clinical use.

Additonally, MLOps frameworks enable and learn from deviations, further enhancing their efficacy in healthcare applications.

Real World Application – Early Detection of Chronic Disease, Infectious Disease Monitoring

Healthcare Fraud Detection

Real World Application – Claims Analysis, Identify Theft Prevention

Medical Imaging Analysis

Real World Application – Early Cancer Detection, Neurological Disorders Diagnosis

Genomic Research

Real World Application – Cancer Genomics, Rare Genetic Diseases

Real World Application – Protein Folding Prediction, Drug Toxicity Prediction

Personalised Medicine

Real World Application – Oncology and Targeted Therapies, Chronic Disease Management

Healthcare Resource Management

Real World Application – Emergency Room Digitalised Management, Pharmaceutical Supply Chain Management

Real World Application – Prediction of recovery time and quality of life, Adverse Effects, Short term and long term impact

Remote Patient Monitoring

Real World Application – Chronic Disease Management, Post Surgery Monitoring

Moreover, the ethical considerations extend to the strategic utilisation of data. The foundation of responsible AI in healthcare is laid upon a robust ethical framework that guides the entire lifecycle of Neuromorphic and Multimodal AI systems. Stakeholders must unwaveringly adhere to established ethical principles, ensuring transparency, fairness, and accountability at every stage of AI implementation.

When we delve into the realm of Gen AI, the potential for malpractice looms. Consider scenarios where a patient, with normal renal function manageable through medication, undergoes a renal scan. Unscrupulous use of Gen AI could manipulate images, creating false lesions, leading to unnecessary surgeries or even nephrectomy which can benefit illegal organ trade

Thus, the imperative lies in defining strong ethical boundaries, implementing robust audits, and establishing legal frameworks to prevent data manipulation and ensure the highest standards of integrity.

In embracing these technological advancements responsibly, we are not just witnessing the future of healthcare; we are actively shaping it. The era of proactive, preventive healthcare beckons, promising a future where wellness is at the forefront of the industry’s evolution.

The shift from traditional, one-size-fits-all medical practices, prone to misinterpretation and diagnostic errors, to AI-enhanced methodologies, heralds a new era of precision and personalised care. AI’s capability to analyse a broad spectrum of patient data—ranging from genetic backgrounds to lifestyle factors—promises a departure from misdiagnoses and introduces tailored therapeutic interventions.

AI and multimodal technologies enable a holistic view of the patient’s health, integrating diverse data points. While, Neuromorphic computing advances the portability of medical devices, including wearables and implants, transforming them into intelligent systems capable of adapting to varying conditions.

As thought leaders in the healthcare industry, our commitment to responsibly integrate these technologies paves the way for a future where healthcare is not only reactive, but anticipatory, personalised, and universally accessible.

Author

Anup S S

Practice Head, Artificial Intelligence, Tata Elxsi

Anup S.S. is a visionary in leveraging Artificial Intelligence, Machine Learning and Deep Learning. Leading breakthrough AI projects in healthcare, Anup’s strategic insight and innovation ignite client success, unlocking AI’s full potential.

© 2024 TATA ELXSI

PRIVACY POLICY

COOKIE POLICY

TERMS OF USE

Facebook Twitter Youtube Linkedin Instagram Envelope

Multimodal AI and Neuromorphic AI: Detection, Diagnosis, Prognosis - Tata Elxsi

Discover how Multimodal and Neuromorphic AI lead healthcare from reactive to proactive. This article delves into Responsible AI and its transformative impact.

ai.tataelxsi.com

ai.tataelxsi.com

MULTIMODAL AI AND NEUROMORPHIC AI: DETECTION, DIAGNOSIS, PROGNOSIS

Navigate

The synergy of cutting-edge technologies like Multimodal and Neuromorphic AI signals a pivotal shift from reactive to proactive healthcare. This article explores captivating use cases, offering insights on the implementation of Responsible AI.

Join us as we navigate the frontier of healthcare, where the synergy of innovation and responsibility promises a revolution in patient care and well-being.

Current state of AI adoption in Healthcare

Unlocking the full potential of AI in healthcare is an uncharted journey. From optimising drug combinations to spearheading clinical correlation and toxicity studies, AI is set to redefine every facet of the industry. Despite its transformative capabilities, AI remains a niche technology, requiring a nuanced understanding of its application in healthcare.The tides are changing as the healthcare sector recognises the urgency for an interdisciplinary approach, marrying engineering with medical science. This paradigm shift signals an imminent era where AI’s vast capabilities will revolutionise diagnostics, patient treatment, protocols, drug development and delivery, and prescription practices over the next decade.

Join us as we navigate the frontier of healthcare, where the synergy of innovation and responsibility promises a revolution in patient care and well-being.

Multimodal AI and Neuromorphic Technology – A new era in Preventive Healthcare

In the ever-evolving landscape of healthcare, the amalgamation of Multimodal AI and Neuromorphic Technology marks a pivotal moment—a shift from reactive medicine to a proactive, preventive healthcare paradigm. This synergy is not just a collaboration of cutting-edge technologies; it’s a gateway to a future where wellness takes centre stage.

These technologies hold promise to transform healthcare by enhancing diagnostics, enabling personalised medicine, predicting long-term prognosis and contributing to innovations in therapeutic interventions.

Let’s delve into compelling use cases and glimpse the future of preventive healthcare.

The tides are changing as the healthcare sector recognises the urgency for an interdisciplinary approach, marrying engineering with medical science. This paradigm shift signals an imminent era where AI’s vast capabilities will revolutionise diagnostics, patient treatment, protocols, drug development and delivery, and prescription practices over the next decade.

Join us as we navigate the frontier of healthcare, where the synergy of innovation and responsibility promises a revolution in patient care and well-being.

Defining Multimodal and Neuromorphic AI

Multi-modal AI

Multimodal AI refers to the artificial intelligence systems that process and analyse data from multiple modalities or sources. In healthcare, these modalities often include both visual and clinical data. Visual data may include medical images from scans, while clinical data encompasses patient records, parameters, and test reports. Multimodal AI integrates these diverse data types to provide a comprehensive understanding, draw meaningful insights and give suggestions based on data and image analytics.Neuromorphic Technology

The term “neuromorphic” comes from the combination of “neuro” (related to the nervous system) and “morphic” (related to form or structure). Neuromorphic technology is an innovative approach in computing that draws inspiration from the structure and function of a human brain. These are AI powered by brain-like computing architectures. It can help process larger amount of data with less computing power, memory and electric power consumption. Neuromorphic Technology utilises Artificial Neural Networks (ANN) and Spiking Neural Networks (SNN) to mimic the parallel processing, event-driven nature, and adaptability observed in biological brains.

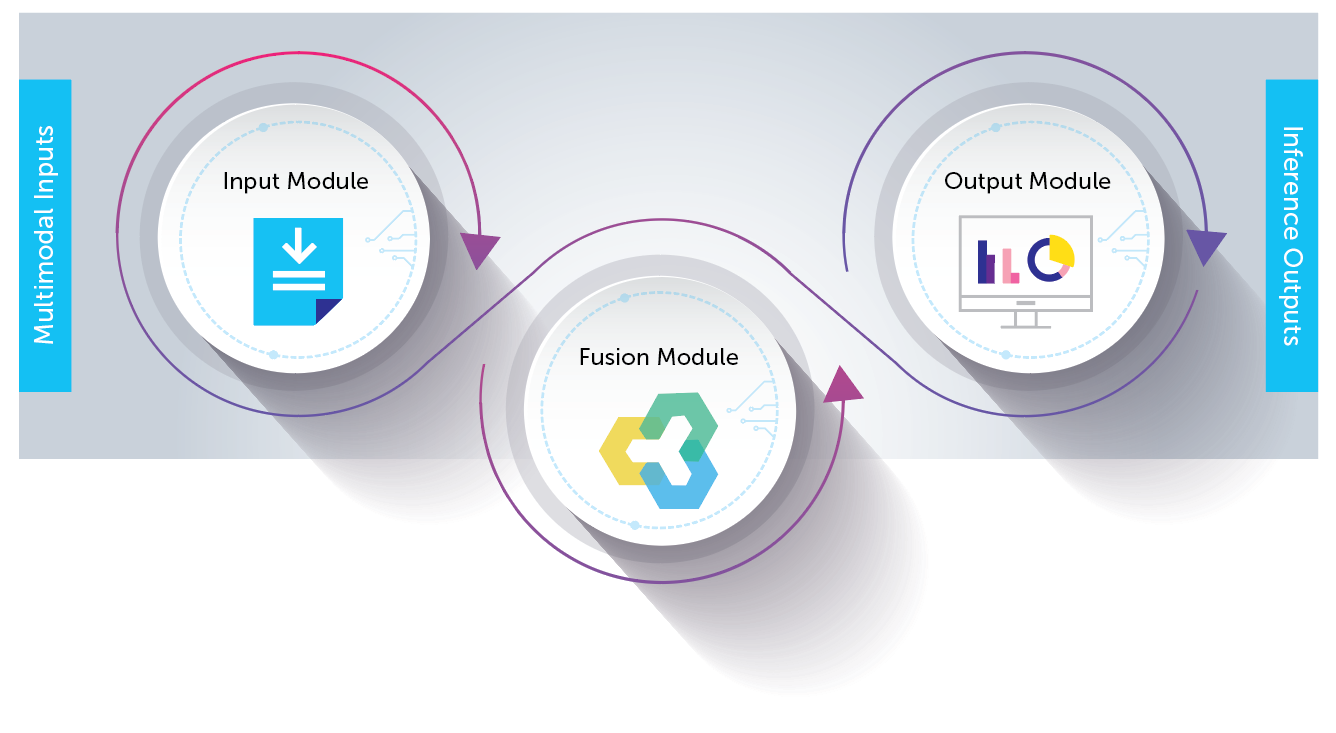

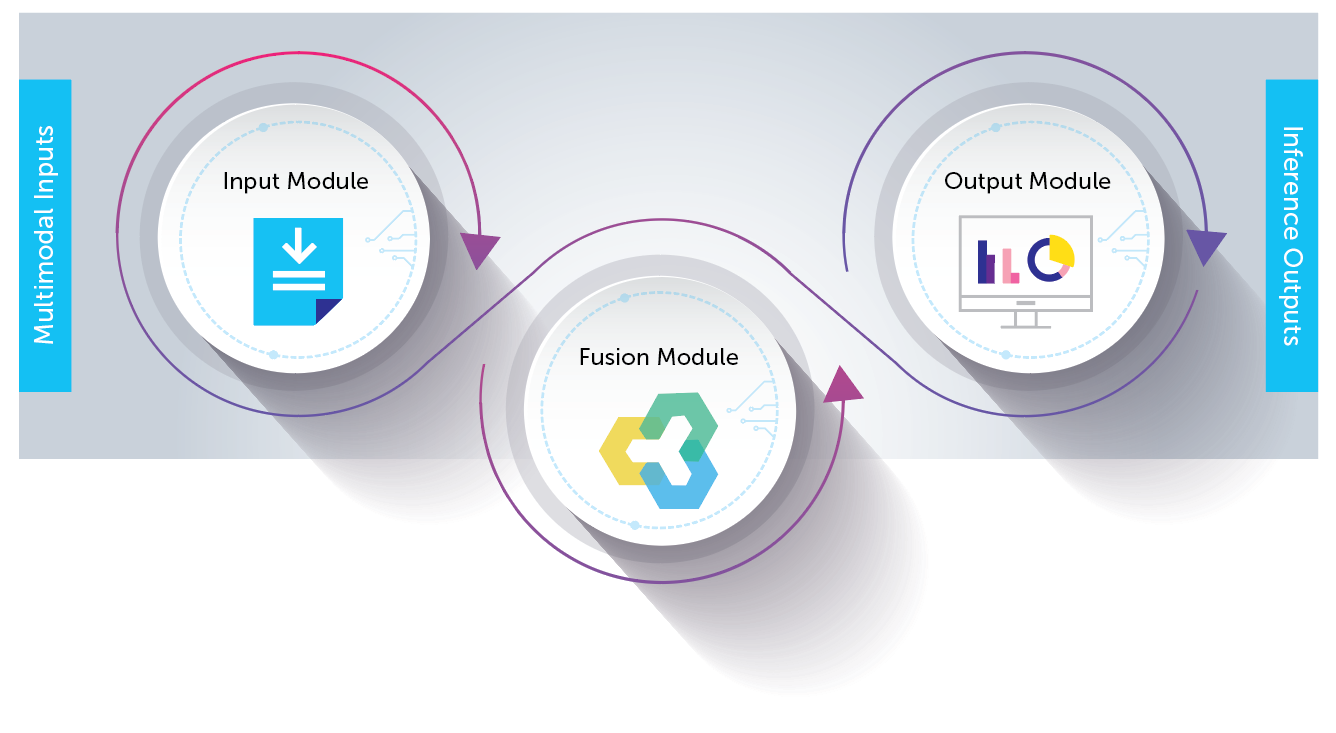

Multimodal Inputs

- Medical Images

- Lab Reports

- Clinical History

- Patient Demographic Information

Fusion Module

Cross-modal attention mechanism to dynamically weigh the importance of text, video, and other parameters for calculating index to decide priority of selection.Inference Outputs

Inference Results for- Diagnostic

- Prognostic

- Lifestyle Recommendation

- Disease Prediction

Use Cases of Multimodal and Neuromorphic AI

Early Screening & Disease Detection

Multimodal AI

- Integrates visual and clinical data for holistic analysis.

- Advanced –image recognition for early detection.

- Comprehensive patient profiling.

Neuromorphic Technology

- Efficient pattern recognition for subtle disease indicators.

- Event-driven processing for real-time detection. This is crucial for detecting anomalies or irregularities that may be early signs of diseases.

- Continuous monitoring for dynamic changes. This continuous surveillance is especially valuable for conditions with varying symptoms.

Diagnosis

Multimodal AI

- Integrated diagnostic insights from diverse data.

- Cross-verification for reliability.

- Tailored treatment plans based on nuanced understanding.

- Continuous updates based on latest findings reported in the subject.

Neuromorphic Technology

- Large and Efficient data processing with minimal energy consumption. This efficiency contributes to faster and more accurate diagnoses.

- Allows integration of more complex algorithms on wearable devices; makes diagnostics more real-time and helps timely interventions

- Implantable devices can be made AI enabled with Neuromorphic computing, due to the low computing requirement and power consumption, making the diagnosis and management more precise and real-time.

- Adaptive intelligence for dynamic adjustments. This adaptability enhances the precision of diagnostic processes. This event-driven processing aligns with the dynamic nature of healthcare data allowing for more accurate and timely diagnoses.

- SNN for real-time response

and accuracy.

Prognosis

Multimodal AI

- Research Advancements: Facilitates discovery of new insights, contributing to medical advancements and innovations.

- Personalised Prognostic Models: Considering both visual and clinical data, these models account for individual variations, and correlate with prior case records and provide more accurate predictions of disease outcomes.

- Dynamic Adaptability: The adaptability of multimodal AI to changing data patterns ensures that prognostic models can dynamically adjust based on evolving patient conditions and improve prognosis predictions

Neuromorphic Technology

- Analysis of longitudinal data for predicting disease progression.

- Dynamic adaptability in prognostic models that can adjust to changing data patterns. This adaptability improves prognosis prediction accuracy for evolving patient conditions.

- Personalised prognostic insights based on individual variations can help in more accurate predictions tailored to individual patient profiles.

Tata Elxsi Use Case

Disease Detection and Diagnosis

Utilising Neuromorphic Technology, we’ve achieved significant advancements in the analysis of medical images on low-computing embedded platforms, enabling on-field diagnostics of ultrasound images.This innovative approach provides critical diagnostic information for musculoskeletal injuries, including tissue damage extent, recovery progress, and healing time predictions, all with enhanced efficiency and device portability making it ideal for applications such as sports medicine.

Applications of Multimodal and Neuromorphic AI

Multimodal AI

- Comprehensive Patient Analysis

- Diagnostic Accuracy

- Mental Health and Behavioural Analysis

- Lifestyle Reviews and Recommendations

- Management of Chronic Diseases like Diabetes/HT/Cardiac Diseases with continous monitoring and personalised medications

- Diagnosis/Management and Prognosis of various types of cancers, Digital Drug Trials, Effective Pandemic Surveillance and staging, Gene Therapy and Genomics

- Recommendations for interventions and Prioritisation of therapeutic resources and modalities

Neuromorphic Technology

- Implants, Wearables Devices

- Processing Large Data

- Medical Imaging Analysis

- Drug Discovery and Personalised Medicine

- Robotic Surgery Assistance

- Neurological Disorder Understanding

- Patient Care and Rehabilitation

- Predictive Analytics for Healthcare Management

- Energy Efficient Remote Monitoring

The Synergy of MLOps and Advanced AI

The transformative impact of MLOps across operational efficiency, data management, patient outcomes, and the overall quality of care is unmistakable. In the quest for advancing healthcare, the convergence of Machine Learning Operations (MLOps) with Multimodal and Neuromorphic AI has emerged as a game-changer. These technologies can help in seamless deployment, continuous monitoring, and collaborative development across various stakeholders in the healthcare ecosystem.While Advanced AI Technologies offer the potential for improvising the use cases, the application of MLOps can be instrumental in strengthening and regulating these advancements. It achieves this by bringing in streamlined AI development processes, dataset management, continuous monitoring of model accuracy across different versions, ensuring the deployment of thoroughly vetted versions for clinical use.

Additonally, MLOps frameworks enable and learn from deviations, further enhancing their efficacy in healthcare applications.

Use Cases

Disease Detection

Disease Prediction and PreventionReal World Application – Early Detection of Chronic Disease, Infectious Disease Monitoring

Healthcare Fraud Detection

Real World Application – Claims Analysis, Identify Theft Prevention

Medical Imaging Analysis

Real World Application – Early Cancer Detection, Neurological Disorders Diagnosis

Genomic Research

Real World Application – Cancer Genomics, Rare Genetic Diseases

Diagnosis

Drug Discovery and DevelopmentReal World Application – Protein Folding Prediction, Drug Toxicity Prediction

Personalised Medicine

Real World Application – Oncology and Targeted Therapies, Chronic Disease Management

Healthcare Resource Management

Real World Application – Emergency Room Digitalised Management, Pharmaceutical Supply Chain Management

Prognosis

Prediction of Clinical OutcomeReal World Application – Prediction of recovery time and quality of life, Adverse Effects, Short term and long term impact

Remote Patient Monitoring

Real World Application – Chronic Disease Management, Post Surgery Monitoring

Responsible AI – Navigating Ethical Frontiers

In the realm of AI, addressing bias stands as a pivotal ethical imperative, particularly in fields like medical analysis where the demand for precision is ethically, legally, and morally paramount. As AI practitioners, our commitment to responsible AI requires rigorous testing using diverse, unbiased anonymised datasets, continual monitoring to mitigate biases, and a steadfast dedication to achieving fair outcomes across diverse patient populations.

Moreover, the ethical considerations extend to the strategic utilisation of data. The foundation of responsible AI in healthcare is laid upon a robust ethical framework that guides the entire lifecycle of Neuromorphic and Multimodal AI systems. Stakeholders must unwaveringly adhere to established ethical principles, ensuring transparency, fairness, and accountability at every stage of AI implementation.

When we delve into the realm of Gen AI, the potential for malpractice looms. Consider scenarios where a patient, with normal renal function manageable through medication, undergoes a renal scan. Unscrupulous use of Gen AI could manipulate images, creating false lesions, leading to unnecessary surgeries or even nephrectomy which can benefit illegal organ trade

Thus, the imperative lies in defining strong ethical boundaries, implementing robust audits, and establishing legal frameworks to prevent data manipulation and ensure the highest standards of integrity.

In embracing these technological advancements responsibly, we are not just witnessing the future of healthcare; we are actively shaping it. The era of proactive, preventive healthcare beckons, promising a future where wellness is at the forefront of the industry’s evolution.

The shift from traditional, one-size-fits-all medical practices, prone to misinterpretation and diagnostic errors, to AI-enhanced methodologies, heralds a new era of precision and personalised care. AI’s capability to analyse a broad spectrum of patient data—ranging from genetic backgrounds to lifestyle factors—promises a departure from misdiagnoses and introduces tailored therapeutic interventions.

AI and multimodal technologies enable a holistic view of the patient’s health, integrating diverse data points. While, Neuromorphic computing advances the portability of medical devices, including wearables and implants, transforming them into intelligent systems capable of adapting to varying conditions.

As thought leaders in the healthcare industry, our commitment to responsibly integrate these technologies paves the way for a future where healthcare is not only reactive, but anticipatory, personalised, and universally accessible.

Author

Anup S S

Practice Head, Artificial Intelligence, Tata Elxsi

Anup S.S. is a visionary in leveraging Artificial Intelligence, Machine Learning and Deep Learning. Leading breakthrough AI projects in healthcare, Anup’s strategic insight and innovation ignite client success, unlocking AI’s full potential.

Book Your Exclusive Print Copy Now!

© 2024 TATA ELXSI

PRIVACY POLICY

COOKIE POLICY

TERMS OF USE

Facebook Twitter Youtube Linkedin Instagram Envelope