“But I don't believe that and think GPUs are still required in cars in addition to Akida.” was my opinion to the question I asked you in my reply to you. In your reply you quoted Peter but what he had said was he needed 100 Akida1000 chips. Again this makes the original claim unbalanced and does that mean 100x AKIDA 1.0 out performs GPUs and CPUs? In any case these are big claims and if correct, should be somewhere in company presentations, yet I don't recall seeing this in any of the presentations.

I'm sure our development team is well aware of Akida's capabilities and probably thats why they are targeting the edge AI market. Now if a 25 dollar Akida1.0 could replace a 2000 dollar odd GPU then that would be one of our biggest use cases, and as alwaysgreen pointed out Akida would be flying off shelves. Also don't forget all the GPUs that Akida could replace in crypto mining and those are big polluters. So why is BRN not marketing these if Akida could do the same at very low power and outperform GPUs??

As for the Sandia article, I thank you for posting that and I enjoyed reading it. I quoted their concluding remarks to highlight that we can't generalise that "AKIDA 1.0 out performs GPUs and CPUs." without specifying in what way.

Also I never said that Akida has no use cases in gaming. "Gaming" is a very broad term and you are taking things out of context. There are lots of elements there like VR headsets, cameras, and all those different types of game controllers. This discussion was about Akida1.0 Vs GPUs/CPUs and here is what I said for clarity.

"If I'm not correct I would like to be pointed to at least one presentation slide or other company source that claims that Akida can replace GPUs in cars or other graphics-heavy applications like gaming."

About my comment on you making fun, this is what I was referring to.

This was my original post.

View attachment 20667

This is the first comment I was referring to: post #34,739

View attachment 20668

I was not aware there was some sort of a ranking system in TSEx similar to the army.

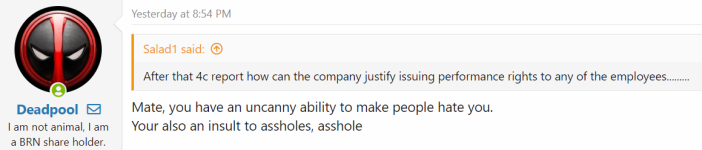

This is the second one in post #34,794

View attachment 20669

I don't really care about the second one but didn't appreciate the first one. Would have been better if you had come directly at me if you thought my post was an attempt to diminish the importance of your post without commenting elsewhere. Anyway please don't waste your time to go back and remove or edit these.