F

Filobeddo

Guest

or maybe Nearenough??View attachment 8370

Interestingly RT likes but no comment belowI guess surely they know each other with 22yrs behind him, and surely there is no doubting he was ever Goodenough !!

or maybe Nearenough??View attachment 8370

Interestingly RT likes but no comment belowI guess surely they know each other with 22yrs behind him, and surely there is no doubting he was ever Goodenough !!

So does that mean we get a new breed of morons on HCJust a word of warning about moving into the ASX200 for when it occurs.

Those institutions that have to buy the ASX200 also lend shares for shorting.

Thus larger more financially literate shorters become involved.

This then attracts larger more sophisticated traders who know what the shorters are going to do and follow their lead.

In the early days of the spice trade in England and Europe sailing ships would set sail to Asia for the purpose of trading to bring back these valuable commodities. The journey was long and very dangerous yet for those who embarked on the journey and survived the roaring forties rounding the cape and privateer attacks the riches which flowed on a successful return were extraordinary.

In many ways the investment journey on the ASX apart from the risk to life is similar, though an angry spouse might pose a physical threat, at every turn there are new bigger obstacles as you get closer to the golden ring.

The manipulators will be more articulate and subtle. Suggesting risks of different types and feigning friendship. The trades and shorts will come in bigger more sophisticated waves.

Just like those involved in the spice trade those who stay the course, ignore the distractions and complete the journey will be rewarded.

Abandoning ship guarantees failure.

My opinion only DYOR

FF

AKIDA BALLISTA

Yes.Just a word of warning about moving into the ASX200 for when it occurs.

Those institutions that have to buy the ASX200 also lend shares for shorting.

Thus larger more financially literate shorters become involved.

This then attracts larger more sophisticated traders who know what the shorters are going to do and follow their lead.

In the early days of the spice trade in England and Europe sailing ships would set sail to Asia for the purpose of trading to bring back these valuable commodities. The journey was long and very dangerous yet for those who embarked on the journey and survived the roaring forties rounding the cape and privateer attacks the riches which flowed on a successful return were extraordinary.

In many ways the investment journey on the ASX apart from the risk to life is similar, though an angry spouse might pose a physical threat, at every turn there are new bigger obstacles as you get closer to the golden ring.

The manipulators will be more articulate and subtle. Suggesting risks of different types and feigning friendship. The trades and shorts will come in bigger more sophisticated waves.

Just like those involved in the spice trade those who stay the course, ignore the distractions and complete the journey will be rewarded.

Abandoning ship guarantees failure.

My opinion only DYOR

FF

AKIDA BALLISTA

www.edgeimpulse.com

www.edgeimpulse.com

So does that mean we get a new breed of morons on HC

I'm an ADR buyer the volume is and has always been low. I bought them cause these shares are not shortable so I thought for a long term view they are the best for me. I also have asx shares and yeah they are liquid like mad hence the volitility. I bought the ADR not for trades but a 5 to 10 year picture when they are finally in demand you will see action but at that time it will be listed on the NASDQ and well north of today's prices.Yes, yes,....you are probably right BL. Mostly I am a frustrated by the lack of volume and virtually zero ADR volumes. Why? Why is there not interest in the ADR shares? And I was seconding Diogenes concern(s) about a lack of interest beyond Australia and Germany, keep in mind.

Cramer is a clown show. Agree, and I was being "somewhat" facetious.

But can someone advise what has the Integrous relationship provided during the last year? I'm sure Brainchip is paying for something?

Are others happy with the success of Integrous ... " (helping to) attract additional institutional investment while maximizing the returns for our current shareholders " ??? I'm not.

That quote is from the July 14, 2021 Business Wire announcement of our new Integrous association. It also states that Integrous will lead Brainchip's financial communications and strategic investor relations initiatives. Oh? Is that so?

Perhaps our Brainchip - Integrous investor relations initiatives are under NDA's. What else can explain that all we hear from this relationship are crickets?

Oh, well, at least U.S. retail nudged BRCHF shares up 4% today.

Regards, dippY

Seagars joining the board of directors for Edge Impulse is Huge news for BrainChip.

So does that mean we get a new breed of morons on HC

I wonder who's board of directors he may also join........................................wouldn't rule it out considering the large portion of former ARM employees we already have on the books.Seagars joining the board of directors for Edge Impulse is Huge news for BrainChip.

“Unlocking our world's potential through smarter, more efficient, and accessible computing has been a consistent theme in my professional journey,” Simon says. “Edge Impulse shares this vision and is at the center of the next frontier of edge computing, by empowering developers to harness machine learning across all classes of edge devices.”

HELLS CORNERWhat is HC anyway?

Hi @LearningI haven't seen this been discussed on TSEX, not sure about the old place.

BOSCH Center for Artificial Intelligence has been studying SNN for years

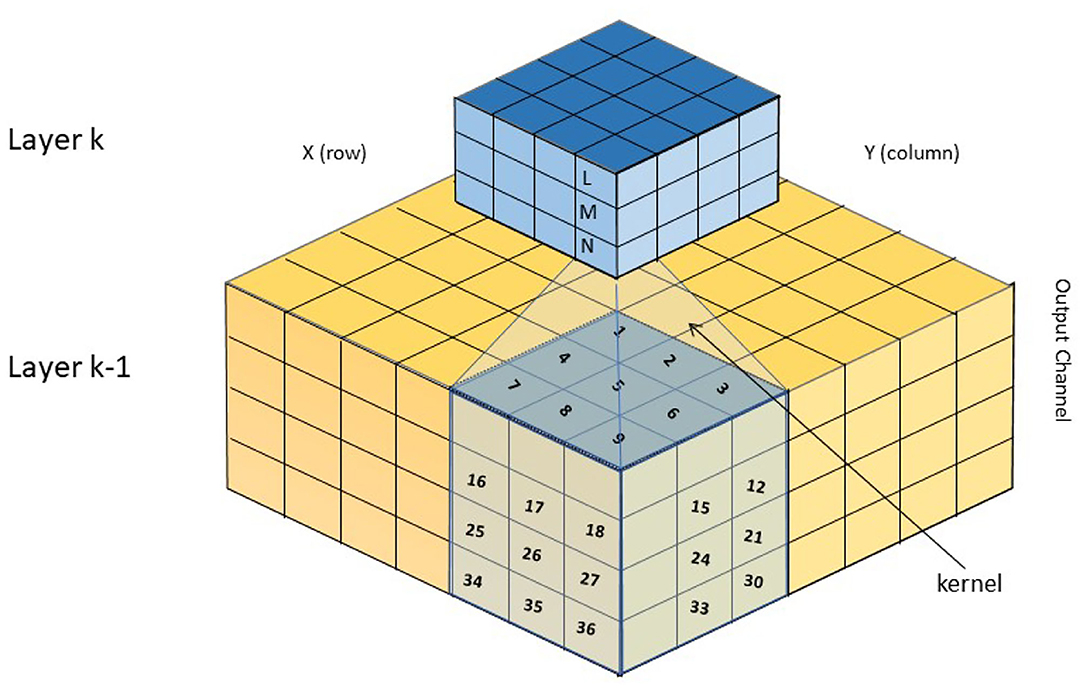

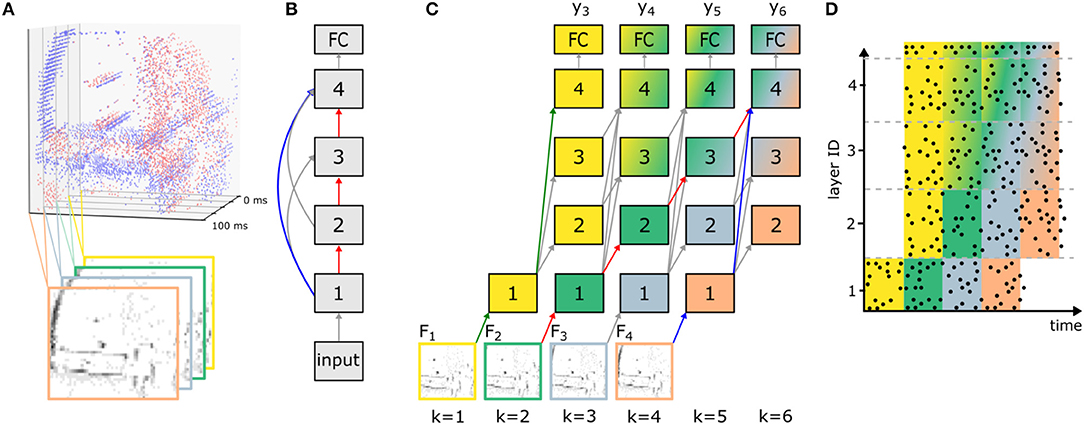

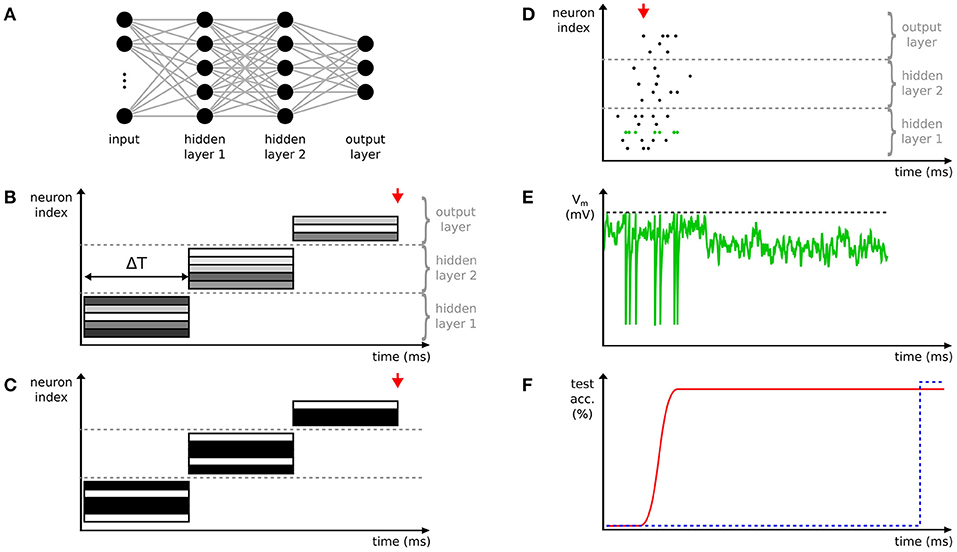

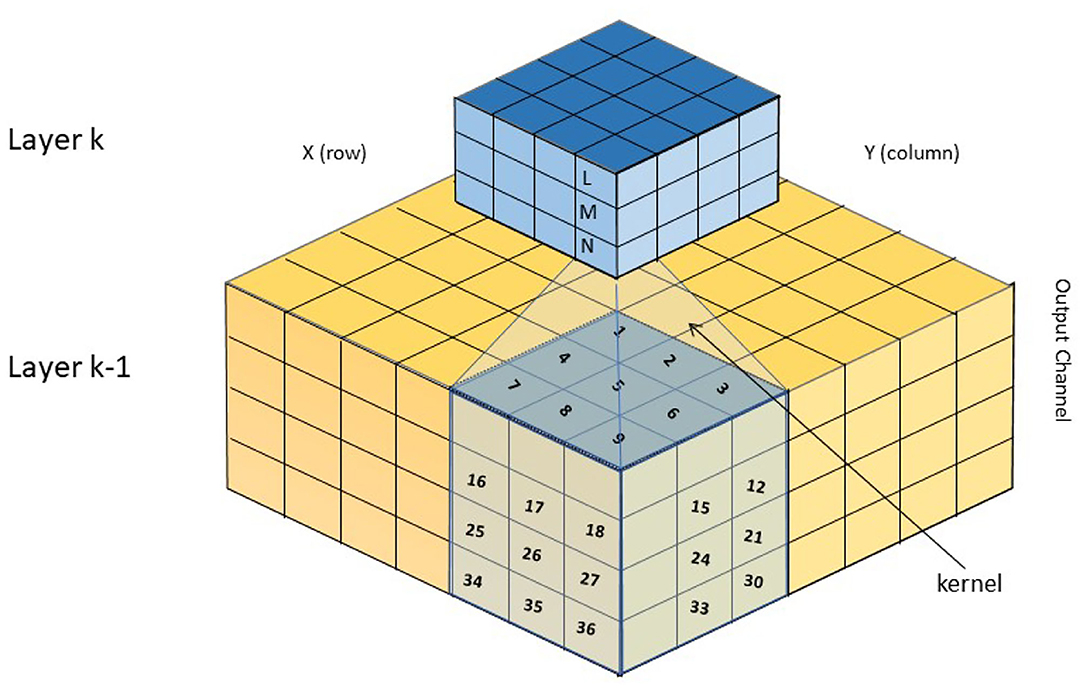

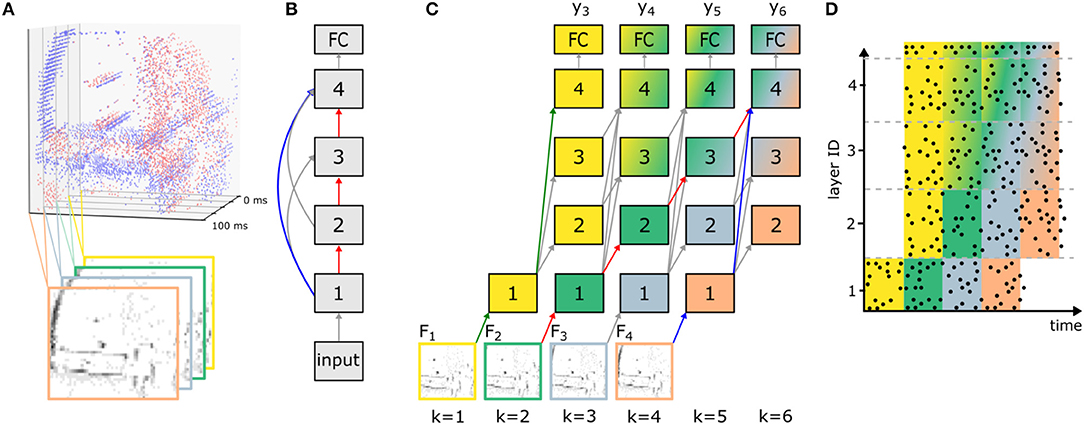

Frontiers | Comparison of Artificial and Spiking Neural Networks on Digital Hardware

Despite the success of Deep Neural Networks - a type of Artificial Neural Network (ANN) - in problem domains such as image recognition and speech processing,...www.frontiersin.org

Frontiers | Efficient Processing of Spatio-Temporal Data Streams With Spiking Neural Networks

Spiking neural networks (SNNs) are potentially highly efficient models for inference on fully parallel neuromorphic hardware, but existing training methods t...www.frontiersin.org

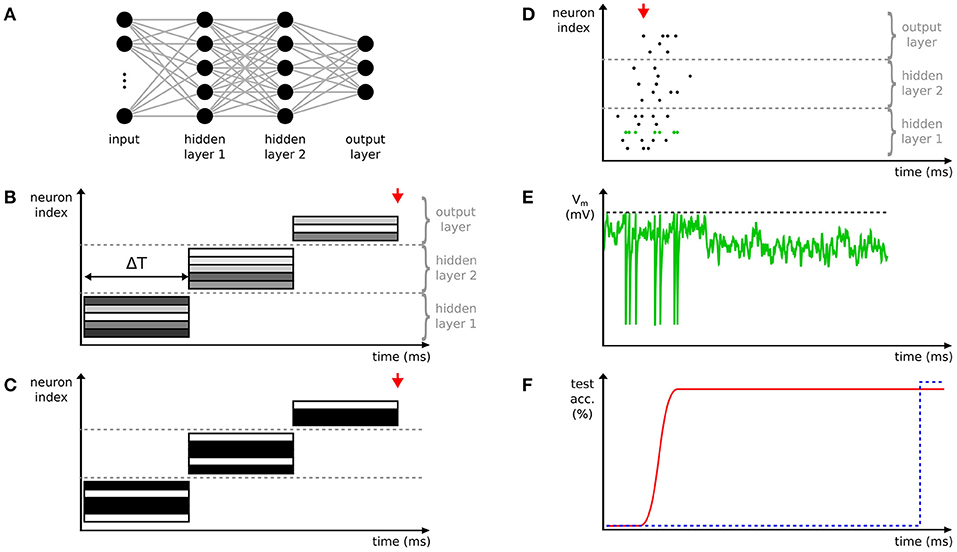

Frontiers | Deep Learning With Spiking Neurons: Opportunities and Challenges

Spiking neural networks (SNNs) are inspired by information processing in biology, where sparse and asynchronous binary signals are communicated and processed...www.frontiersin.org

Can some of our more learned members draw inference from the above studies from BOSCH.

Its great to be a shareholder

Learning.

I should add that while Bosch is a truly great company last year they sat at number 6 in a list of global providers of semiconductors to the automotive industry and Renesas was at number 3.Hi @Learning

We spent a lot of time and energy over on HC looking at Bosch and @uiux is a Bosch savant.

The bottom line is they have been trying to play catch-up and unfortunately for them Peter van der Made has been there and done that and blown up the bridges behind him.

The following extract sets out the problem they are yet to resolve

“Adaptively rescaling the SNN weights or firing thresholds could be a solution to alleviate this effect. This can be seen as a kind of homeostasis mechanism that keeps the overall firing rates of SNNs at a constant level.”

But this problem is already dealt with and the solution patented by Peter van der Made so if they eventually get passed this point in their research and seek a patent then likely will suffer pushback.

Despite Brainchip holding a patent for CNN to SNN conversion you will notice there is not one reference to Brainchip in this paper which is rather telling as they are clearly not confident they have found a more efficient work around.

In fact they are still a long way from a solution as the above extract makes clear and as they state in their concluding paragraph more research is required.

They also state in their paper that they are yet to identify how to create the hardware upon which to run their converter which also has been done and patented by Peter van der Made and team.

My opinion only DYOR

FF

AKIDA BALLISTA

Hi @Learning

We spent a lot of time and energy over on HC looking at Bosch and @uiux is a Bosch savant.

The bottom line is they have been trying to play catch-up and unfortunately for them Peter van der Made has been there and done that and blown up the bridges behind him.

The following extract sets out the problem they are yet to resolve

“Adaptively rescaling the SNN weights or firing thresholds could be a solution to alleviate this effect. This can be seen as a kind of homeostasis mechanism that keeps the overall firing rates of SNNs at a constant level.”

But this problem is already dealt with and the solution patented by Peter van der Made so if they eventually get passed this point in their research and seek a patent then likely will suffer pushback.

Despite Brainchip holding a patent for CNN to SNN conversion you will notice there is not one reference to Brainchip in this paper which is rather telling as they are clearly not confident they have found a more efficient work around.

In fact they are still a long way from a solution as the above extract makes clear and as they state in their concluding paragraph more research is required.

They also state in their paper that they are yet to identify how to create the hardware upon which to run their converter which also has been done and patented by Peter van der Made and team.

My opinion only DYOR

FF

AKIDA BALLISTA

Thank you FFHi @Learning

We spent a lot of time and energy over on HC looking at Bosch and @uiux is a Bosch savant.

The bottom line is they have been trying to play catch-up and unfortunately for them Peter van der Made has been there and done that and blown up the bridges behind him.

The following extract sets out the problem they are yet to resolve

“Adaptively rescaling the SNN weights or firing thresholds could be a solution to alleviate this effect. This can be seen as a kind of homeostasis mechanism that keeps the overall firing rates of SNNs at a constant level.”

But this problem is already dealt with and the solution patented by Peter van der Made so if they eventually get passed this point in their research and seek a patent then likely will suffer pushback.

Despite Brainchip holding a patent for CNN to SNN conversion you will notice there is not one reference to Brainchip in this paper which is rather telling as they are clearly not confident they have found a more efficient work around.

In fact they are still a long way from a solution as the above extract makes clear and as they state in their concluding paragraph more research is required.

They also state in their paper that they are yet to identify how to create the hardware upon which to run their converter which also has been done and patented by Peter van der Made and team.

My opinion only DYOR

FF

AKIDA BALLISTA

Makes me wonder why they bother trying. Just bolt on some Akida IP and forge ahead.Thank you FF

For your in-depth wisdom.

Learning