Lattelarry

Regular

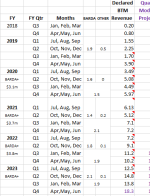

Found the answer in the notes. So they sold $2.1m to BARDA but only got payment for $1.7 so far.I saw it here:

View attachment 37926

Unfortunately that's my spreadsheet and I don't have a note on that cell as to where it came from. If I get time, I will go back and see if I can find it.

Your evidence is compelling - but not sure it sounds right - too low. 2022 was $3.8m, up on $3.7m, up on $3.1m. Constantly growing. $1.7m for 1H23 seems too low.

Yep. Extra sales wouldn't spike production costs at all due to margins.

Last edited: