You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

AVZ Discussion 2022

- Thread starter GazDix

- Start date

Remark

Top 20

I'm not sure but they seem a little more relaxed here & anti HC which is greatSo who’s the mods in charge here? Is it Stock Exchange like HC?

Remark

Top 20

Sorry, I will never utter that name again. I feel your pain.What serenity?? Thought we escaped from that name but here you are bringing it up

Dijon101

Regular

My bet would be Thursday 10th Feb - 2pm

Oh God if only. 10th is my birthday.

And as far as moderating goes I do believe zeebot has said that he's a number of methods set up to remove and keep a handle of all the trolls and paid downramping.

I'm in AVZ and BRN and already the brn forums here are so much less toxic than hc

TheCount

Regular

ML not allowed to be issued before Frank's ML Bitter has fermented, bottled, been delivered, and conditioned..... 2 weeks should be enough..

Looking forward to some legitimate discussions without the uncontrolled lies and useless low-content posts from paid meat puppets.

Interesting paid article on news.com.au about WA Lithium.

Cheers,

TC.

Looking forward to some legitimate discussions without the uncontrolled lies and useless low-content posts from paid meat puppets.

Interesting paid article on news.com.au about WA Lithium.

Cheers,

TC.

Dijon101

Regular

Another stock that the discussion on that other site had devolved into toxic bickering, copy pasted bullshit and half truths.

Bought in and accumulated so my average price is at 19c

Back above 80c now and I've heard every story under the sun why AVZ would not go to mine or that we would be going back to 20c.

Onwards and upwards !!

Bought in and accumulated so my average price is at 19c

Back above 80c now and I've heard every story under the sun why AVZ would not go to mine or that we would be going back to 20c.

Onwards and upwards !!

TheCount

Regular

Morgan Stanley getting in on the act:-

When the automobile industry began mass producing cars in the late 1940s, it sparked a booming oil economy encompassing everything from massive refineries to the corner gas station. More than half a century later, the automobile is once again reshaping established supply chains and creating a new industrial order—only this one is built on the high-density lithium-ion batteries that power Electric Vehicles (EVs).

Most investors understand that increasing demand for EVs is driving growth for battery makers and related industries. What the market may not fully appreciate, however, is the speed, breadth and complexity of the burgeoning global battery economy.

Now, a combination of factors, including a new urgency for government and corporates to decarbonize and surging investments by auto and battery manufacturers, has shifted the battery market into high gear.

“The battery economy could do for this century what oil did for the last,” says Adam Jonas, who heads Morgan Stanley's Global Auto & Shared Mobility research. In response, Jonas and more than 25 of his equity analyst colleagues have created a new Global Battery team to map the entire value chain of battery electric vehicles (BEVs). In a recent collaborative Bluepaper, the Research team identified 71 companies under their coverage that are best positioned for the exponential growth in the EV battery economy.

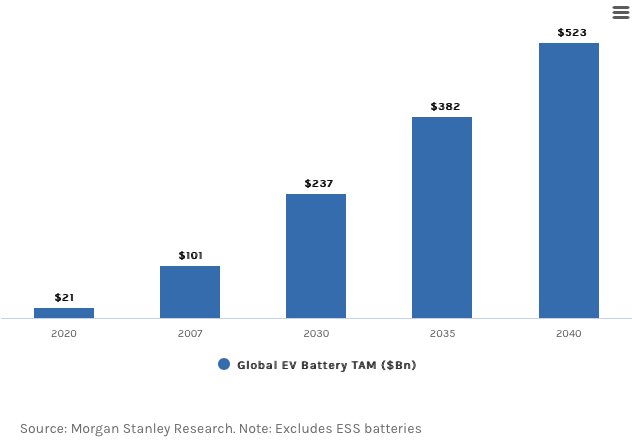

More than a single industry, batteries are a key investment theme with a total addressable market that could surpass $525 billion by 2040. “This story involves multiple sectors across cell manufacturing, specialty chemicals mining, equipment, components, machinery, packaging, and automakers,” Jonas adds. As with any secular theme, the story will continue to evolve, but here are key things investors should know.

The Global EV Battery Market is Poised to Reach $525 billion by 2040

The chart has 1 X axis displaying categories.

The chart has 1 Y axis displaying values. Range: 0 to 600.

End of interactive chart.

Source: Morgan Stanley Research. Note: Excludes ESS batteries

The company opened doors for increased EV adoption, which in turn led to more investments in battery technology, and ultimately cheaper, better batteries. In fact, costs have come a long way since 2010, when battery prices were $1,100/kWh, representing a 90% drop over ten years to about $110/kWh today.

Meanwhile, post-Covid climate polices and environmental, social, and governance (ESG) mandates have accelerated adoption. “The pandemic accelerated the development of the battery economy by at least five, if not 10 years,” says Shawn Kim, who heads the Asia Technology research team at Morgan Stanley. The amount of capital investment in batteries is now 10 to 20 times higher than it was pre-Covid.

Related Reading

https://www.morganstanley.com/ideas/electrification-grid-energy-transition-opportunities

Battery Trend May Span Decades

Major secular themes rarely follow a linear path, and batteries are no different. “We think it's helpful to think in terms of stages of development or 'epochs' as the story of the battery economy unfolds,” says Stephen Byrd, Head of U.S. Power & Utilities and Clean Energy.

If the last decade was about proof of concept, the current epoch might be defined as the “Wild West” of batteries, during which time surging EV penetration leads to a rapid period of project financing and joint ventures in the battery space—and raises the risk of excess capacity globally. This epoch could also bring what analysts call the “balkanization” of the battery industry as governments and regions establish their own secure supplies of batteries in the name of national energy security.

The next epoch—beginning around 2030—could be marked by significant consolidation, as well as higher levels of standardization and commoditization. During this period, we also expect to see well-capitalized new tech players challenging today’s leaders.

Beyond that, “we believe the automobile business model itself is fundamentally transformed into a transport utility where a combination of cheap batteries, renewable energy, and autonomy drive the incremental cost of the vehicle mile traveled to near zero,” says Jonas.

While the auto industry is carrying the necessary burden of revolutionizing the industry, batteries will likely be more widely applied to sectors of the future, including the internet of things (IoT), industrial autonomy, robotics, or defense.

Still, there are many unknowns and risks to navigate along the way. “The battery industry is highly complex with dozens of mini self-reinforcing and some self-correcting supply/demand curves to take into consideration,” says Jonas. Indeed, many of the same factors that are driving the bull case for EV penetration could ultimately pose risks for today’s battery incumbents—as was the case for solar, LED and other emerging industries.

The Morgan Stanley Global Battery team has identified four potential blind spots, including excess investment, the “balkanization” of the battery business, OEM vertical integration, and obsolescence risk on the way to cell and manufacturing breakthroughs.

In fact, lithium-ion batteries could ultimately be replaced by new technologies. The battery of the future may not even look like a cube or a cylinder. It could look like an airplane wing, car body, or phone case with a thin sheet of woven glass that separates the two electrodes.

No doubt, the global battery market will continue to evolve, which is all the more reason for investors to plug into this secular theme.

For more Morgan Stanley Research on electrification, ask your Morgan Stanley representative or Financial Advisor for the full report, “The New Oil: Investment Implications of the Global Battery Economy” (Nov. 15, 2021). Plus, more Ideas.

The global battery economy is shifting into high gear thanks to rapid EV adoption, improving technology and a new urgency for governments and corporates to decarbonize. A look at key takeaways for investors on this emerging theme.

When the automobile industry began mass producing cars in the late 1940s, it sparked a booming oil economy encompassing everything from massive refineries to the corner gas station. More than half a century later, the automobile is once again reshaping established supply chains and creating a new industrial order—only this one is built on the high-density lithium-ion batteries that power Electric Vehicles (EVs).

Most investors understand that increasing demand for EVs is driving growth for battery makers and related industries. What the market may not fully appreciate, however, is the speed, breadth and complexity of the burgeoning global battery economy.

Now, a combination of factors, including a new urgency for government and corporates to decarbonize and surging investments by auto and battery manufacturers, has shifted the battery market into high gear.

“The battery economy could do for this century what oil did for the last,” says Adam Jonas, who heads Morgan Stanley's Global Auto & Shared Mobility research. In response, Jonas and more than 25 of his equity analyst colleagues have created a new Global Battery team to map the entire value chain of battery electric vehicles (BEVs). In a recent collaborative Bluepaper, the Research team identified 71 companies under their coverage that are best positioned for the exponential growth in the EV battery economy.

More than a single industry, batteries are a key investment theme with a total addressable market that could surpass $525 billion by 2040. “This story involves multiple sectors across cell manufacturing, specialty chemicals mining, equipment, components, machinery, packaging, and automakers,” Jonas adds. As with any secular theme, the story will continue to evolve, but here are key things investors should know.

The Global EV Battery Market is Poised to Reach $525 billion by 2040

Chart

The chart has 1 X axis displaying categories.

The chart has 1 Y axis displaying values. Range: 0 to 600.

End of interactive chart.

Source: Morgan Stanley Research. Note: Excludes ESS batteries

Battery Market Has Shifted into High Gear

Battery technology has been around for more than two centuries—but the last decade has marked a major turning point for batteries spurred in no small part by Tesla.The company opened doors for increased EV adoption, which in turn led to more investments in battery technology, and ultimately cheaper, better batteries. In fact, costs have come a long way since 2010, when battery prices were $1,100/kWh, representing a 90% drop over ten years to about $110/kWh today.

Meanwhile, post-Covid climate polices and environmental, social, and governance (ESG) mandates have accelerated adoption. “The pandemic accelerated the development of the battery economy by at least five, if not 10 years,” says Shawn Kim, who heads the Asia Technology research team at Morgan Stanley. The amount of capital investment in batteries is now 10 to 20 times higher than it was pre-Covid.

Related Reading

https://www.morganstanley.com/ideas/electrification-grid-energy-transition-opportunities

Battery Trend May Span Decades

Major secular themes rarely follow a linear path, and batteries are no different. “We think it's helpful to think in terms of stages of development or 'epochs' as the story of the battery economy unfolds,” says Stephen Byrd, Head of U.S. Power & Utilities and Clean Energy.

If the last decade was about proof of concept, the current epoch might be defined as the “Wild West” of batteries, during which time surging EV penetration leads to a rapid period of project financing and joint ventures in the battery space—and raises the risk of excess capacity globally. This epoch could also bring what analysts call the “balkanization” of the battery industry as governments and regions establish their own secure supplies of batteries in the name of national energy security.

The next epoch—beginning around 2030—could be marked by significant consolidation, as well as higher levels of standardization and commoditization. During this period, we also expect to see well-capitalized new tech players challenging today’s leaders.

Beyond that, “we believe the automobile business model itself is fundamentally transformed into a transport utility where a combination of cheap batteries, renewable energy, and autonomy drive the incremental cost of the vehicle mile traveled to near zero,” says Jonas.

While the auto industry is carrying the necessary burden of revolutionizing the industry, batteries will likely be more widely applied to sectors of the future, including the internet of things (IoT), industrial autonomy, robotics, or defense.

Investors Should Beware Blind Spots

Drawing on experience investing in other emerging technologies, Morgan Stanley analysts outlined a roadmap for investors navigating new adoption cycles. Early in the cycle, enablers of a new technology tend to lead the way. Subsequently, value creation shifts to the infrastructure and device makers with higher penetration. Toward the end of the cycle, opportunities shift to software and services companies that are able to capitalize on the growth of EVs.Still, there are many unknowns and risks to navigate along the way. “The battery industry is highly complex with dozens of mini self-reinforcing and some self-correcting supply/demand curves to take into consideration,” says Jonas. Indeed, many of the same factors that are driving the bull case for EV penetration could ultimately pose risks for today’s battery incumbents—as was the case for solar, LED and other emerging industries.

The Morgan Stanley Global Battery team has identified four potential blind spots, including excess investment, the “balkanization” of the battery business, OEM vertical integration, and obsolescence risk on the way to cell and manufacturing breakthroughs.

In fact, lithium-ion batteries could ultimately be replaced by new technologies. The battery of the future may not even look like a cube or a cylinder. It could look like an airplane wing, car body, or phone case with a thin sheet of woven glass that separates the two electrodes.

No doubt, the global battery market will continue to evolve, which is all the more reason for investors to plug into this secular theme.

For more Morgan Stanley Research on electrification, ask your Morgan Stanley representative or Financial Advisor for the full report, “The New Oil: Investment Implications of the Global Battery Economy” (Nov. 15, 2021). Plus, more Ideas.

Touchstone

Emerged

AVZ looking very strong today. The Lithium sector looking good for the next few years and AVZ has a host of announcements due that should continue to spark interest. I'm looking for $1.25 to $1.30 should price break the dollar mark. Long term it is a hold for me.

To add - if enough community report a post, it becomes automatically moderated until I review it. This means we are all effectively moderating 24/7!Community reporting. @zeeb0t will moderate trolls etc He has a nice plan for trolls and blatant downramping/misinformation

AlpineLife

Member

with The ASX 300 rebalance 1 March, & the opportunity to buy in super, wouldn’t mind the price staying affordable until then. Not a down ramper, just a very LT holder that wants more with tax offset benefits!

Azzler

Top 20

Greetings AVZ investers!

It's incredible they've allowed the rubbish and toxic culture to persist back on HC, it's been going on for ever though.

Let us hope this becomes something much more productive and informative.

Looking forward to the years to come with AVZ, for those who've held since before xmas last year, congratulations on making a bucket load of money!!!!

I'm on the cusp of resigning from work forever, just waiting on the ML for peace of mind.

I've already made more money than I dreamed I would, though of course I risked quite a bit.

And there's much more to come.... If only we could get our hands on that BFS!!! I think the calculations of share price once in production are going to shock many.

I anticipate many delays in getting to production to be honest, but I can't imagine anything putting a complete stop to the AVZ machine, barring all out war or something crazy.

Hold on to your shares and keep your chin up!

and DYOR!

Not financial advice.

It's incredible they've allowed the rubbish and toxic culture to persist back on HC, it's been going on for ever though.

Let us hope this becomes something much more productive and informative.

Looking forward to the years to come with AVZ, for those who've held since before xmas last year, congratulations on making a bucket load of money!!!!

I'm on the cusp of resigning from work forever, just waiting on the ML for peace of mind.

I've already made more money than I dreamed I would, though of course I risked quite a bit.

And there's much more to come.... If only we could get our hands on that BFS!!! I think the calculations of share price once in production are going to shock many.

I anticipate many delays in getting to production to be honest, but I can't imagine anything putting a complete stop to the AVZ machine, barring all out war or something crazy.

Hold on to your shares and keep your chin up!

and DYOR!

Not financial advice.

LzrTr8dr

Regular

JAG, glad to see that you made it over here after the absolute circus on HC. Look forward to your continued contribution to the thread - thanks mate!Morning All.

I look forward to learning and contributing to a decent, troll free thread

JAG72

Similar threads

- Replies

- 6

- Views

- 2K

- Replies

- 0

- Views

- 885

- Replies

- 0

- Views

- 825

- Replies

- 0

- Views

- 1K